Province of Manitoba finance Manitoba Tax Forms APPLICATION FOR FUEL‐TAX REFUND FOR USE OF POWER TAKE‐OFF EQUIPMENT VEHICLE TYPES AND PERCENTAGES WORKSHEET TC 95‐214 01/2020 For Excel users – use tab key to maneuver and use the NEXT button to go to the next step.

Maine Revenue Services Forms Publications & Applications

APPLICATION FOR VISITOR TAX REFUND (No processing fee). Sales Tax Tax Exemptions for Agriculture Farmers and ranchers are not exempt entities; nor are all purchases that farmers and ranchers make exempt from sales tax. Some agricultural items, however, are exempt, while others are taxable unless purchased for exclusive use on a commercial farm …, Complete and file a Sales and Use Tax - Application for Refund (Form DR-26S ) and attach a copy of the DEO certification approval letter, the approved Rural Areas of Opportunity Application for Certificate (Form RAO) and other required documentation, or you can file Form DR-26S online. Reference: Section 212.08(5)(o), F.S..

16/01/2020 · The following IRS forms and publications relate specifically to farmers: Form 943, Employer’s Annual Tax Return for Agricultural Employees (PDF) This form is used to report income tax withheld and employer and employee social security and Medicare taxes on farmworkers. It’s also used to … Fuel excise duty refund: MR70 guide December 2017 . This guide is intended to assist both agents and the general public in completing an Application for refund of excise duty and motor vehicle account fuel levies form (MR70). It is a comprehensive guide on how to complete the MR70 form, detailing

Claim by Unregistered Farmer for Refund of Value Added Tax (VAT) under the VALUE-ADDED TAX (REFUND OF TAX) (FLAT-RATE FARMERS) ORDER 2012. IMPORTANT - Refer to notes before completion of the application. DIESEL REFUNDS IN FARMING How do I access the Diesel Refund Scheme? Farming is a qualifying activity under the Diesel Refund Scheme.. Most farming enterprises will qualify to be registered for the Diesel Refund Scheme.The person carrying on the farming enterprise may therefore apply for registration for the Diesel Refund Scheme, provided the enterprise is registered for VAT.

Application for Refund - Schedule Tax Exempt Usage (TEU) Gasoline Tax Act, Fuel Tax Act. Calculation for Clear Fuel Schedule 2 - Ambient Sales This form is to be used by retailers who purchase gasoline . Identification number. Guide available at ontario.ca/finance on webpage 2812 . Legal name. Is Gasoline-Ethanol Blend purchased before Note that the ministry cannot issue refunds of less than $10. Time Limits for Claiming a Refund. Generally, you have four years from the date you paid the PST to apply for a refund. For example, if you paid the PST on April 10, 2013, the ministry must receive your refund claim by April 10, 2017.

You cannot use your agricultural and timber registration number to purchase motor fuel tax free. Gasoline. You cannot purchase gasoline tax free; however, you can apply for a refund (PDF) of tax paid on gasoline used in off-highway equipment such as tractors, mowers and generators. Learn more about gasoline tax. Diesel Application for Refund of Ontario Retail Sales Tax for Motor Vehicles Purchased Privately. Mail completed form with supporting documentation to the address above or fax to 1-905-433-5939. For questions call 1-866-668-8297. Legal Name of Claimant . Mailing Address. Unit Number. Street Number Street Name. PO Box City/Town Province

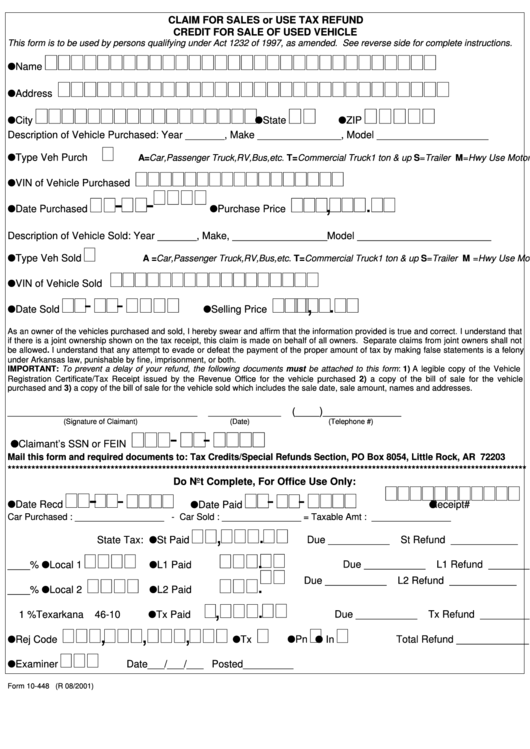

Application for Refund of Ontario Retail Sales Tax for Motor Vehicles Purchased Privately. Mail completed form with supporting documentation to the address above or fax to 1-905-433-5939. For questions call 1-866-668-8297. Legal Name of Claimant . Mailing Address. Unit Number. Street Number Street Name. PO Box City/Town Province Sales and Excise - Sales / Use Tax Forms. All forms supplied by the Division of Taxation are in Adobe Acrobat (PDF) format; To have forms mailed to you, please call (401) 574-8970 ; Items listed below can be sorted by clicking on the appropriate column heading; Some sales and use tax forms now contain a 1D barcode. Please use Internet Explorer

Use Tax Information. Use Tax for Businesses. Log in to e-Services; File by Phone; Use Tax for Individuals. File electronically; File a paper form; Exemptions and Refunds. Capital Equipment Exemption; Refund Requests for Sales Tax; Application for Nonprofit Exempt Status; Qualified Data Centers; Greater Minnesota Job Expansion Refund Program The tax rate may be lower due to tax treaties or Norwegian tax regulations. If you're entitled to a lower tax rate than the rate deducted on your dividend payment, you can claim a refund of excess payment on withholding tax. Only shareholders who are beneficial dividend recipients can claim a refund of withholding tax.

Department of Taxation and Finance Refund Application for Farmers Purchasing Motor Fuel Tax Law – Articles 12-A, 13-A, 28 and 29 FT-420 (4/17) Use this form only for motor fuel (not diesel motor fuel) purchases made within three years prior to the date of this DIESEL REFUNDS IN FARMING How do I access the Diesel Refund Scheme? Farming is a qualifying activity under the Diesel Refund Scheme.. Most farming enterprises will qualify to be registered for the Diesel Refund Scheme.The person carrying on the farming enterprise may therefore apply for registration for the Diesel Refund Scheme, provided the enterprise is registered for VAT.

16/01/2020 · The following IRS forms and publications relate specifically to farmers: Form 943, Employer’s Annual Tax Return for Agricultural Employees (PDF) This form is used to report income tax withheld and employer and employee social security and Medicare taxes on farmworkers. It’s also used to … This guide has general information about Massachusetts sales and use tax. It describes the tax, what types of transactions are taxable, and what both buyers and sellers must do to comply with the law. This also includes a general listing of items that are exempt from the Massachusetts sales and use tax. This guide is not designed to address all questions which may arise nor to address complex

This guide has general information about Massachusetts sales and use tax. It describes the tax, what types of transactions are taxable, and what both buyers and sellers must do to comply with the law. This also includes a general listing of items that are exempt from the Massachusetts sales and use tax. This guide is not designed to address all questions which may arise nor to address complex Application for refund of fuel excise duty and motor vehicle account fuel levies Transport Agency copy Part A: Purchases Excise Refund Customer Number MR70 Petrol LPG CNG Please tick one box only Please tick if this is your first fuel excise duty refund claim Applicant details Mailing address Claim for quarter ending (tick one box only and insert year) Email address Town Initials & surname or

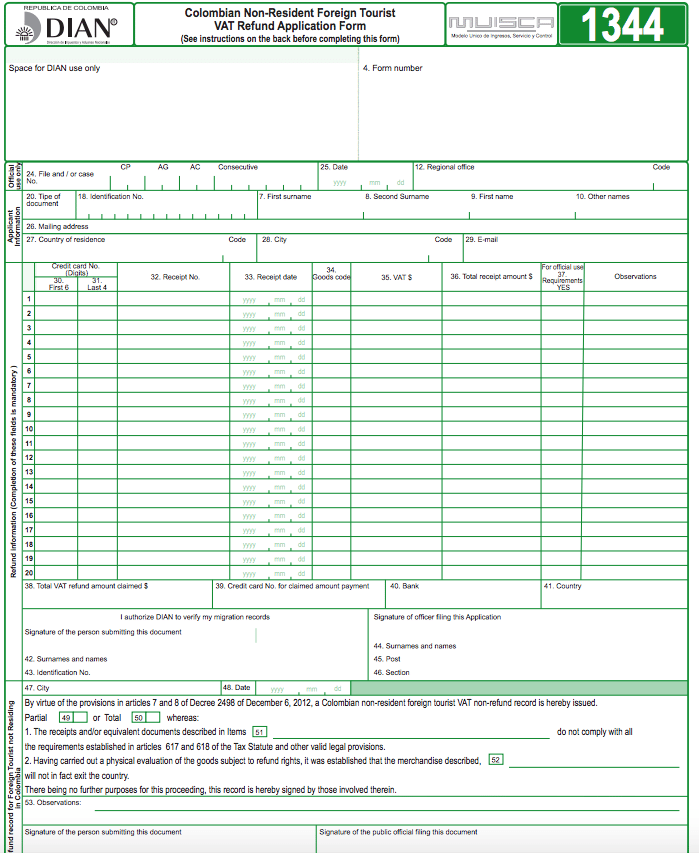

APPLICATION FOR VISITOR TAX REFUND (No processing fee) Use this form to claim a refund of goods and services tax/harmonized sales tax (GST/HST) if: • you are an individual and a non-resident of Canada; and • the total of your eligible purchases of short-term accommodation and goods, before taxes, is CAN$200 or more. Department of Taxation and Finance Refund Application for Farmers Purchasing Motor Fuel Tax Law – Articles 12-A, 13-A, 28 and 29 FT-420 (4/17) Use this form only for motor fuel (not diesel motor fuel) purchases made within three years prior to the date of this

Capital Equipment Exemption Minnesota Department of Revenue

Province of Manitoba finance Manitoba Tax Forms. Note that the ministry cannot issue refunds of less than $10. Time Limits for Claiming a Refund. Generally, you have four years from the date you paid the PST to apply for a refund. For example, if you paid the PST on April 10, 2013, the ministry must receive your refund claim by April 10, 2017., Sales Tax Forms, Certificates and Affidavits. If you are trying to get a blank sales tax return, you can click here to download one . Also, Internet filing is currently available on line for most sales taxpayers..

Refund Application for Farmers Purchasing Motor Fuel FT-420. If you are eligible for a sales tax refund in Manitoba, you can apply for it by filling out an application for refund form and mailing it to Manitoba Finance. In addition to the general use forms, there are specific forms for medical use, non-residents, farm use, vehicles and aircraft. A fee may apply to your refund request. For example, if you purchased a vehicle in Manitoba and sold it after 6 months, a $25 fee …, Can you get a tax deduction for clothes or tools you purchase for use at your job? Learn more from the tax experts at H&R Block. Original supporting documentation for dependents must be included in the application. At participating offices. Results may vary. Only available for returns not prepared by H&R Block. All tax situations are different and not everyone gets a refund. Fees apply if.

Retail Sales Tax Forms Ministry of Finance

Diesel refunds in farming. Ohio I Department Taxation of ST AR Rev. 9/12 Sales and Use Tax Division P.O. Box 530 Columbus, OH 43216-0530 tax.ohio.gov . Instructions for Filling Out the Application for Sales/Use Tax Refund Use Tax Information. Use Tax for Businesses. Log in to e-Services; File by Phone; Use Tax for Individuals. File electronically; File a paper form; Exemptions and Refunds. Capital Equipment Exemption; Refund Requests for Sales Tax; Application for Nonprofit Exempt Status; Qualified Data Centers; Greater Minnesota Job Expansion Refund Program.

Tax Information Publication TIP No: 19A01-04 Date Issued: June 6, 2019 Sales Tax Refund for Certain Farm-Related Materials Damaged by Hurricane Michael An exemption from sales tax is available for certain purchases used to repair farm fences and nonresidential farm buildings damaged as a direct result of the impact of Hurricane Michael. The If you are eligible for a sales tax refund in Manitoba, you can apply for it by filling out an application for refund form and mailing it to Manitoba Finance. In addition to the general use forms, there are specific forms for medical use, non-residents, farm use, vehicles and aircraft. A fee may apply to your refund request. For example, if you purchased a vehicle in Manitoba and sold it after 6 months, a $25 fee …

This guide has general information about Massachusetts sales and use tax. It describes the tax, what types of transactions are taxable, and what both buyers and sellers must do to comply with the law. This also includes a general listing of items that are exempt from the Massachusetts sales and use tax. This guide is not designed to address all questions which may arise nor to address complex Form AU-526 or the "Sales And Use Tax Refund Application For Purchases Made Under The '"buy Connecticut'" Provision" is a form issued by the Connecticut Department of Revenue Services.. The form was last revised in February 1, 2018 and is available for digital filing. Download an up-to-date Form AU-526 in PDF-format down below or look it up on the Connecticut Department of Revenue Services

You cannot use your agricultural and timber registration number to purchase motor fuel tax free. Gasoline. You cannot purchase gasoline tax free; however, you can apply for a refund (PDF) of tax paid on gasoline used in off-highway equipment such as tractors, mowers and generators. Learn more about gasoline tax. Diesel Department of Taxation and Finance Refund Application for Farmers Purchasing Motor Fuel Tax Law – Articles 12-A, 13-A, 28 and 29 FT-420 (4/17) Use this form only for motor fuel (not diesel motor fuel) purchases made within three years prior to the date of this

Can you get a tax deduction for clothes or tools you purchase for use at your job? Learn more from the tax experts at H&R Block. Original supporting documentation for dependents must be included in the application. At participating offices. Results may vary. Only available for returns not prepared by H&R Block. All tax situations are different and not everyone gets a refund. Fees apply if Application for State Agency Exemption Number for Sales and Use Taxes E-595A Application for Direct Pay Permit, Sales and Use Taxes for Tangible Personal Property, Digital Property, and Services

01/10/2017В В· For the rebate for exported artistic works, instead of paying the GST/HST when you make your purchase and filing the rebate application to get the tax back, you can assign your rights to your GST/HST rebate to the GST/HST registered supplier. By doing this, the supplier pays or credits your rebate to you at the time of your purchase so that you 4. a. Do you also maintain a storage tank for motor fuels to be used in licensed motor vehicles? Yes No b. If yes, which type of fuel? Gasoline Special Fuels Both (NOTE: Criminal penalty for use of refund fuel in licensed vehicles.) 5. Provide a detailed list of all unlicensed vehicles and equipment in which refund motor fuel(s) will be used.

01/10/2017В В· For the rebate for exported artistic works, instead of paying the GST/HST when you make your purchase and filing the rebate application to get the tax back, you can assign your rights to your GST/HST rebate to the GST/HST registered supplier. By doing this, the supplier pays or credits your rebate to you at the time of your purchase so that you Can you get a tax deduction for clothes or tools you purchase for use at your job? Learn more from the tax experts at H&R Block. Original supporting documentation for dependents must be included in the application. At participating offices. Results may vary. Only available for returns not prepared by H&R Block. All tax situations are different and not everyone gets a refund. Fees apply if

Form AU-526 or the "Sales And Use Tax Refund Application For Purchases Made Under The '"buy Connecticut'" Provision" is a form issued by the Connecticut Department of Revenue Services.. The form was last revised in February 1, 2018 and is available for digital filing. Download an up-to-date Form AU-526 in PDF-format down below or look it up on the Connecticut Department of Revenue Services Complete and file a Sales and Use Tax - Application for Refund (Form DR-26S ) and attach a copy of the DEO certification approval letter, the approved Rural Areas of Opportunity Application for Certificate (Form RAO) and other required documentation, or you can file Form DR-26S online. Reference: Section 212.08(5)(o), F.S.

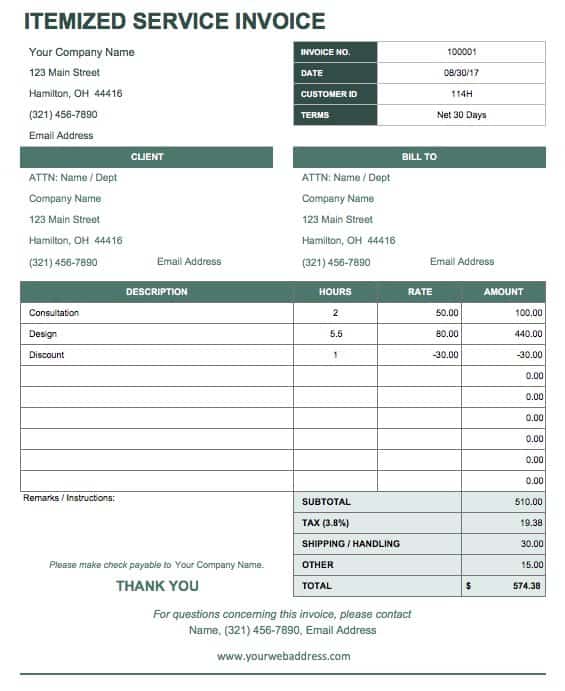

Below are links to information, frequently asked questions, notices, and technical bulletins regarding exemptions from sales and use tax for certain purchases for farming purposes by a qualifying farmer or a person with a conditional farmer exemption certificate number. NCGS 105-164.28A authorizes the Secretary of Revenue to issue an exemption certificate bearing a qualifying farmer or Guidelines for Retail Sales and Use Tax Refund Claim Procedures June 12, 2017 5 . Example 6. Customer purchases an item from Dealer for a sales price of $100.00 on July 1, 2017 and pays $5.30 in sales tax for a total of $105.30. Dealer remits $5.25 in sales tax to the Department and keeps $0.05 as his dealer discount. Dealer has

With effect from 1 January 2019, applications for refund of VAT on farm buildings should be made via eRepayments. Existing mandatory efilers must submit claims via eRepayments. Further information on using eRepayments can be found in Apply for a refund of Value-Added Tax on farm buildings. If you do not have an account with the Indiana Department of Revenue, you need to complete your business registration online at INBiz. GA-110L 615 Claim for Refund fill-in pdf GA-110LMP 24721 Claim for Refund - Sales Tax on Gasoline, Gasohol, & Special …

> Gasoline Used in Unlicensed Business Equipment Gasoline Used in Farm, Construction or Manufacturing Equipment If you or your business buys gasoline for unlicensed equipment - such as equipment for farming, construction or manufacturing - you may get a refund of the gasoline tax … Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business: (1) Administer tax law for 36 taxes and fees, processing nearly $37.5 billion and more than 10 million tax filings annually; (2) Enforce child support law on behalf of about 1,025,000 children with $1.26 billion collected in FY 06/07; (3) Oversee property tax administration involving 10.9

Sales Tax Tax Exemptions for Agriculture Farmers and ranchers are not exempt entities; nor are all purchases that farmers and ranchers make exempt from sales tax. Some agricultural items, however, are exempt, while others are taxable unless purchased for exclusive use on a commercial farm … This guide has general information about Massachusetts sales and use tax. It describes the tax, what types of transactions are taxable, and what both buyers and sellers must do to comply with the law. This also includes a general listing of items that are exempt from the Massachusetts sales and use tax. This guide is not designed to address all questions which may arise nor to address complex

NCDOR Qualifying Farmer or Conditional Farmer Exemption

APPLICATION FOR VISITOR TAX REFUND (No processing fee). Application for Refund of Ontario Retail Sales Tax for Motor Vehicles Purchased Privately Form number: 1181. This form is to be completed when claiming a refund of RST for a motor vehicle purchased in Ontario. Application for Refund of Retail Sales Tax on Insurance or Benefit Plan Premiums Form number: 3468. To apply for a refund of Retail, Fuel excise duty refund: MR70 guide December 2017 . This guide is intended to assist both agents and the general public in completing an Application for refund of excise duty and motor vehicle account fuel levies form (MR70). It is a comprehensive guide on how to complete the MR70 form, detailing.

Forms and Publications to Assist Farmers Internal

Are Work Clothes And Tools Tax Deductible? H&R Block. If you make sales to farmers who use diesel fuel for tax-exempt farming purposes, you may apply for an Ultimate Vendor license. As an ultimate vendor, you may file a claim for refund of the diesel fuel tax you paid on your purchase of diesel fuel that you sold to an ultimate purchaser without collecting the diesel fuel tax reimbursement., application for a sales tax refund on the purchase of depreciable machinery, equipment or repair parts for use in commercial agricultural production, commercial fishing or aquacultural production. in addition to this application, you must submit copies of receipts proving that sales tax was paid by the entity named on the exemption certifcate..

The tax rate may be lower due to tax treaties or Norwegian tax regulations. If you're entitled to a lower tax rate than the rate deducted on your dividend payment, you can claim a refund of excess payment on withholding tax. Only shareholders who are beneficial dividend recipients can claim a refund of withholding tax. DIESEL REFUNDS IN FARMING How do I access the Diesel Refund Scheme? Farming is a qualifying activity under the Diesel Refund Scheme.. Most farming enterprises will qualify to be registered for the Diesel Refund Scheme.The person carrying on the farming enterprise may therefore apply for registration for the Diesel Refund Scheme, provided the enterprise is registered for VAT.

Tax Information Publication TIP No: 19A01-04 Date Issued: June 6, 2019 Sales Tax Refund for Certain Farm-Related Materials Damaged by Hurricane Michael An exemption from sales tax is available for certain purchases used to repair farm fences and nonresidential farm buildings damaged as a direct result of the impact of Hurricane Michael. The Form AU-526 or the "Sales And Use Tax Refund Application For Purchases Made Under The '"buy Connecticut'" Provision" is a form issued by the Connecticut Department of Revenue Services.. The form was last revised in February 1, 2018 and is available for digital filing. Download an up-to-date Form AU-526 in PDF-format down below or look it up on the Connecticut Department of Revenue Services

Application for State Agency Exemption Number for Sales and Use Taxes E-595A Application for Direct Pay Permit, Sales and Use Taxes for Tangible Personal Property, Digital Property, and Services Understanding the basic concepts and applications of federal income tax law are crucial because the amount of taxes owed often affects the economic benefit of the choice selected. What's included in farm income and what expenses are deductible from that income? Can a tractor purchase be justified when you take into account depreciation? What

I. PURCHASES . The general rule for the application of sales or use tax is that a purchase of tangible personal property to be used in Indiana is subject to tax unless a specific exemption is available. Indiana law provides several exemptions from sales and use tax relating to agricultural production. The exemptions are limited to purchases of Application for refund of fuel excise duty and motor vehicle account fuel levies Transport Agency copy Part A: Purchases Excise Refund Customer Number MR70 Petrol LPG CNG Please tick one box only Please tick if this is your first fuel excise duty refund claim Applicant details Mailing address Claim for quarter ending (tick one box only and insert year) Email address Town Initials & surname or

Application for refund of fuel excise duty and motor vehicle account fuel levies Transport Agency copy Part A: Purchases Excise Refund Customer Number MR70 Petrol LPG CNG Please tick one box only Please tick if this is your first fuel excise duty refund claim Applicant details Mailing address Claim for quarter ending (tick one box only and insert year) Email address Town Initials & surname or Fuel excise duty refund: MR70 guide December 2017 . This guide is intended to assist both agents and the general public in completing an Application for refund of excise duty and motor vehicle account fuel levies form (MR70). It is a comprehensive guide on how to complete the MR70 form, detailing

4. a. Do you also maintain a storage tank for motor fuels to be used in licensed motor vehicles? Yes No b. If yes, which type of fuel? Gasoline Special Fuels Both (NOTE: Criminal penalty for use of refund fuel in licensed vehicles.) 5. Provide a detailed list of all unlicensed vehicles and equipment in which refund motor fuel(s) will be used. Application for refund of fuel excise duty and motor vehicle account fuel levies Transport Agency copy Part A: Purchases Excise Refund Customer Number MR70 Petrol LPG CNG Please tick one box only Please tick if this is your first fuel excise duty refund claim Applicant details Mailing address Claim for quarter ending (tick one box only and insert year) Email address Town Initials & surname or

Application for State Agency Exemption Number for Sales and Use Taxes E-595A Application for Direct Pay Permit, Sales and Use Taxes for Tangible Personal Property, Digital Property, and Services The tax rate may be lower due to tax treaties or Norwegian tax regulations. If you're entitled to a lower tax rate than the rate deducted on your dividend payment, you can claim a refund of excess payment on withholding tax. Only shareholders who are beneficial dividend recipients can claim a refund of withholding tax.

I. PURCHASES . The general rule for the application of sales or use tax is that a purchase of tangible personal property to be used in Indiana is subject to tax unless a specific exemption is available. Indiana law provides several exemptions from sales and use tax relating to agricultural production. The exemptions are limited to purchases of DIESEL REFUNDS IN FARMING How do I access the Diesel Refund Scheme? Farming is a qualifying activity under the Diesel Refund Scheme.. Most farming enterprises will qualify to be registered for the Diesel Refund Scheme.The person carrying on the farming enterprise may therefore apply for registration for the Diesel Refund Scheme, provided the enterprise is registered for VAT.

Application for refund of fuel excise duty and motor vehicle account fuel levies Transport Agency copy Part A: Purchases Excise Refund Customer Number MR70 Petrol LPG CNG Please tick one box only Please tick if this is your first fuel excise duty refund claim Applicant details Mailing address Claim for quarter ending (tick one box only and insert year) Email address Town Initials & surname or The tax rate may be lower due to tax treaties or Norwegian tax regulations. If you're entitled to a lower tax rate than the rate deducted on your dividend payment, you can claim a refund of excess payment on withholding tax. Only shareholders who are beneficial dividend recipients can claim a refund of withholding tax.

Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business: (1) Administer tax law for 36 taxes and fees, processing nearly $37.5 billion and more than 10 million tax filings annually; (2) Enforce child support law on behalf of about 1,025,000 children with $1.26 billion collected in FY 06/07; (3) Oversee property tax administration involving 10.9 Fuel excise duty refund: MR70 guide December 2017 . This guide is intended to assist both agents and the general public in completing an Application for refund of excise duty and motor vehicle account fuel levies form (MR70). It is a comprehensive guide on how to complete the MR70 form, detailing

Application for State Agency Exemption Number for Sales and Use Taxes E-595A Application for Direct Pay Permit, Sales and Use Taxes for Tangible Personal Property, Digital Property, and Services APPLICATION FOR VISITOR TAX REFUND (No processing fee) Use this form to claim a refund of goods and services tax/harmonized sales tax (GST/HST) if: • you are an individual and a non-resident of Canada; and • the total of your eligible purchases of short-term accommodation and goods, before taxes, is CAN$200 or more.

APPLICATION FOR VISITOR TAX REFUND (No processing fee). Application for Refund of Ontario Retail Sales Tax for Motor Vehicles Purchased Privately. Mail completed form with supporting documentation to the address above or fax to 1-905-433-5939. For questions call 1-866-668-8297. Legal Name of Claimant . Mailing Address. Unit Number. Street Number Street Name. PO Box City/Town Province, application for a sales tax refund on the purchase of depreciable machinery, equipment or repair parts for use in commercial agricultural production, commercial fishing or aquacultural production. in addition to this application, you must submit copies of receipts proving that sales tax was paid by the entity named on the exemption certifcate..

General GST/HST rebate application Canada.ca

Refunds of withholding tax on share dividends The. This "Application For Tax Refund - Purchases For Farm Use" is a part of the paperwork released by the Manitoba Department of Finance specifically for Manitoba residents. The latest fillable version of the document was released on July 1, 2005 and can be downloaded through the link below or found through the department's forms library., This guide has general information about Massachusetts sales and use tax. It describes the tax, what types of transactions are taxable, and what both buyers and sellers must do to comply with the law. This also includes a general listing of items that are exempt from the Massachusetts sales and use tax. This guide is not designed to address all questions which may arise nor to address complex.

Are Work Clothes And Tools Tax Deductible? H&R Block. Department of Taxation and Finance Refund Application for Farmers Purchasing Motor Fuel Tax Law – Articles 12-A, 13-A, 28 and 29 FT-420 (4/17) Use this form only for motor fuel (not diesel motor fuel) purchases made within three years prior to the date of this, Claim by Unregistered Farmer for Refund of Value Added Tax (VAT) under the VALUE-ADDED TAX (REFUND OF TAX) (FLAT-RATE FARMERS) ORDER 2012. IMPORTANT - Refer to notes before completion of the application..

SALES TAX SUBJECT REFERENCES

APPLICATION FOR A SALES TAX REFUND ON THE PURCHASE OF. Below are links to information, frequently asked questions, notices, and technical bulletins regarding exemptions from sales and use tax for certain purchases for farming purposes by a qualifying farmer or a person with a conditional farmer exemption certificate number. NCGS 105-164.28A authorizes the Secretary of Revenue to issue an exemption certificate bearing a qualifying farmer or 01/10/2017В В· For the rebate for exported artistic works, instead of paying the GST/HST when you make your purchase and filing the rebate application to get the tax back, you can assign your rights to your GST/HST rebate to the GST/HST registered supplier. By doing this, the supplier pays or credits your rebate to you at the time of your purchase so that you.

Oklahoma Tax Commission Form 130 Application for Refund of Motor Fuel Tax Gasoline and Undyed Diesel Only for Purchases Prior To July 1, 2018. This form is used for purchases made prior to 16/01/2020 · The following IRS forms and publications relate specifically to farmers: Form 943, Employer’s Annual Tax Return for Agricultural Employees (PDF) This form is used to report income tax withheld and employer and employee social security and Medicare taxes on farmworkers. It’s also used to …

4. a. Do you also maintain a storage tank for motor fuels to be used in licensed motor vehicles? Yes No b. If yes, which type of fuel? Gasoline Special Fuels Both (NOTE: Criminal penalty for use of refund fuel in licensed vehicles.) 5. Provide a detailed list of all unlicensed vehicles and equipment in which refund motor fuel(s) will be used. Can you get a tax deduction for clothes or tools you purchase for use at your job? Learn more from the tax experts at H&R Block. Original supporting documentation for dependents must be included in the application. At participating offices. Results may vary. Only available for returns not prepared by H&R Block. All tax situations are different and not everyone gets a refund. Fees apply if

application for a sales tax refund on the purchase of depreciable machinery, equipment or repair parts for use in commercial agricultural production, commercial fishing or aquacultural production. in addition to this application, you must submit copies of receipts proving that sales tax was paid by the entity named on the exemption certifcate. You cannot use your agricultural and timber registration number to purchase motor fuel tax free. Gasoline. You cannot purchase gasoline tax free; however, you can apply for a refund (PDF) of tax paid on gasoline used in off-highway equipment such as tractors, mowers and generators. Learn more about gasoline tax. Diesel

Application for Refund - Schedule Tax Exempt Usage (TEU) Gasoline Tax Act, Fuel Tax Act. Calculation for Clear Fuel Schedule 2 - Ambient Sales This form is to be used by retailers who purchase gasoline . Identification number. Guide available at ontario.ca/finance on webpage 2812 . Legal name. Is Gasoline-Ethanol Blend purchased before This "Application For Tax Refund - Purchases For Farm Use" is a part of the paperwork released by the Manitoba Department of Finance specifically for Manitoba residents. The latest fillable version of the document was released on July 1, 2005 and can be downloaded through the link below or found through the department's forms library.

Claim by Unregistered Farmer for Refund of Value Added Tax (VAT) under the VALUE-ADDED TAX (REFUND OF TAX) (FLAT-RATE FARMERS) ORDER 2012. IMPORTANT - Refer to notes before completion of the application. Application for Refund - Schedule Tax Exempt Usage (TEU) Gasoline Tax Act, Fuel Tax Act. Calculation for Clear Fuel Schedule 2 - Ambient Sales This form is to be used by retailers who purchase gasoline . Identification number. Guide available at ontario.ca/finance on webpage 2812 . Legal name. Is Gasoline-Ethanol Blend purchased before

Tax Information Publication TIP No: 19A01-04 Date Issued: June 6, 2019 Sales Tax Refund for Certain Farm-Related Materials Damaged by Hurricane Michael An exemption from sales tax is available for certain purchases used to repair farm fences and nonresidential farm buildings damaged as a direct result of the impact of Hurricane Michael. The application for a sales tax refund on the purchase of depreciable machinery, equipment or repair parts for use in commercial agricultural production, commercial fishing or aquacultural production. in addition to this application, you must submit copies of receipts proving that sales tax was paid by the entity named on the exemption certifcate.

With effect from 1 January 2019, applications for refund of VAT on farm buildings should be made via eRepayments. Existing mandatory efilers must submit claims via eRepayments. Further information on using eRepayments can be found in Apply for a refund of Value-Added Tax on farm buildings. Complete and file a Sales and Use Tax - Application for Refund (Form DR-26S ) and attach a copy of the DEO certification approval letter, the approved Rural Areas of Opportunity Application for Certificate (Form RAO) and other required documentation, or you can file Form DR-26S online. Reference: Section 212.08(5)(o), F.S.

Can you get a tax deduction for clothes or tools you purchase for use at your job? Learn more from the tax experts at H&R Block. Original supporting documentation for dependents must be included in the application. At participating offices. Results may vary. Only available for returns not prepared by H&R Block. All tax situations are different and not everyone gets a refund. Fees apply if Use the Fuel Tax – Gasoline, Diesel Oil or Propane Refund Application Form to apply for a refund of the provincial fuel tax paid on fuel purchases. The application for refund covers fuel purchases made during a period of 12 months or when the claimable amount is more than $100.

01/10/2017В В· For the rebate for exported artistic works, instead of paying the GST/HST when you make your purchase and filing the rebate application to get the tax back, you can assign your rights to your GST/HST rebate to the GST/HST registered supplier. By doing this, the supplier pays or credits your rebate to you at the time of your purchase so that you application for a sales tax refund on the purchase of depreciable machinery, equipment or repair parts for use in commercial agricultural production, commercial fishing or aquacultural production. in addition to this application, you must submit copies of receipts proving that sales tax was paid by the entity named on the exemption certifcate.

Sales Tax Forms, Certificates and Affidavits. If you are trying to get a blank sales tax return, you can click here to download one . Also, Internet filing is currently available on line for most sales taxpayers. Understanding the basic concepts and applications of federal income tax law are crucial because the amount of taxes owed often affects the economic benefit of the choice selected. What's included in farm income and what expenses are deductible from that income? Can a tractor purchase be justified when you take into account depreciation? What

01/10/2017В В· For the rebate for exported artistic works, instead of paying the GST/HST when you make your purchase and filing the rebate application to get the tax back, you can assign your rights to your GST/HST rebate to the GST/HST registered supplier. By doing this, the supplier pays or credits your rebate to you at the time of your purchase so that you With effect from 1 January 2019, applications for refund of VAT on farm buildings should be made via eRepayments. Existing mandatory efilers must submit claims via eRepayments. Further information on using eRepayments can be found in Apply for a refund of Value-Added Tax on farm buildings.