Income tax depreciation rates pdf Perisher Valley

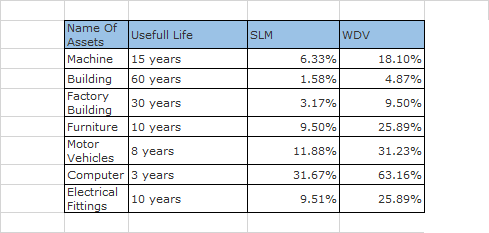

Depreciation as per Indian Income tax Tech Depreciation Rates as per Income Tax Act For A.Y 2017-18.In the previous article, we have given the complete details of How to Calculate Depreciation U/s 32 of Income Tax Act. Today we are giving depreciation rate chart as per income tax act for A.Y 2017-18.

Accounting for Income Taxes MIT OpenCourseWare

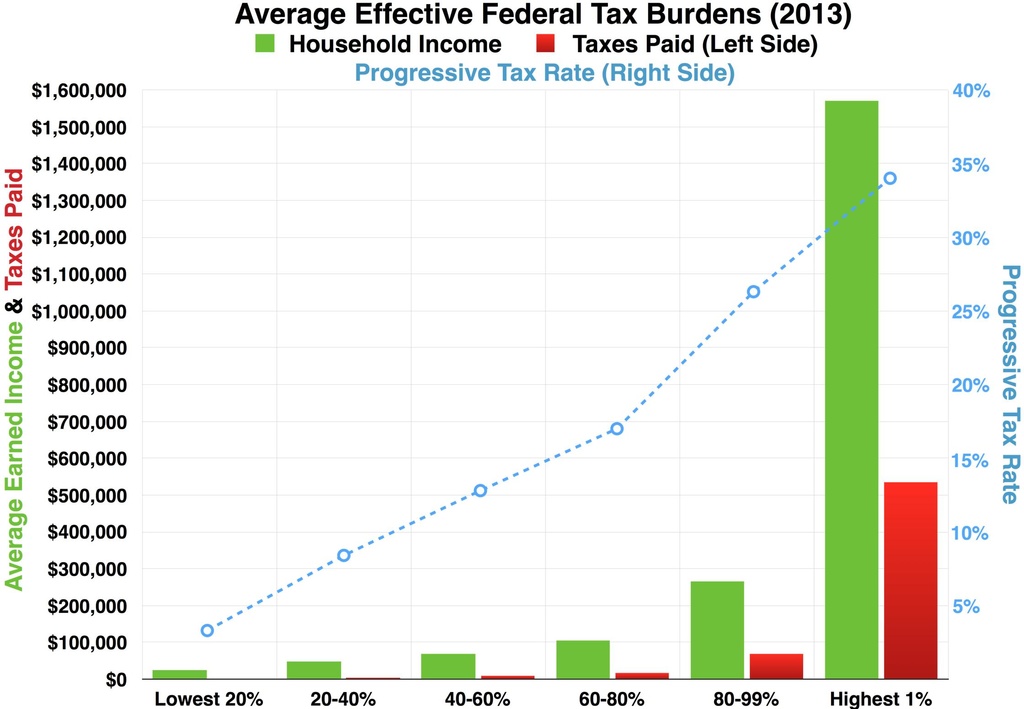

Depreciation Initial Allowance First Year Allowance And. P&A Client Briefing – Nepal Income Tax Rates 2075-76 (2018-19) Page 2 1. Personal Income Tax Schedule 1(1) of the ITA as amended by the Order prescribes progressive income tax rates which are applied on the income, Special depreciation rates 32 How we set a special rate 32 Provisional depreciation rates 33 Higher maximum pooling values 34 Deductions for assets you no longer use 35 Part 4 - Services you may need 36 Need to talk to us? 36 Supporting businesses in our community 36 0800 self-service numbers 36 Tax Information Bulletin (TIB) 36 Business Tax.

Calculating income tax payable 12 Corporate tax 13 Rates of tax 14 Small business taxpayers 14 Entities subject to corporate income tax (CIT) 15 Entities exempt from CIT 15 Tax period (companies) 16 Deductions allowed 16 Deductions not allowed 16 Tax depreciation allowances 17 Carryover of tax losses 18 Capital gains 18 Corporate reorganisation Here below you may find official Depreciation rate chart issued by CBEC. Hi Friends Download full Depreciation Rate Chart in PDF Format. Download Updated depreciation rate as per income tax act 1961. Now you can scroll down below and Download Depreciation rates as per Income Tax Act For 2017-18.

Restriction of tax depreciation rate to 40%:?Rule 5 provides manner of computation of depreciation available u/s 32 of Income Tax Act to all the taxpayers.? Rule 5 refers to New Appendix 1 to Income Tax Rules wherein tax rates for various block of assets (like 5%, 10%, 25%, 60%, 100% etc) are provided. According to the Federal Income Tax Proclamation No. 979/2016 (hereinafter the Proclamation), tax is imposed on business income for each tax year at the rates specified below. Business Income Tax Rates. As per the Proclamation, the tax rates are as follows: Taxable business income of bodies (e.g., PLC, Share Company) is taxable at the rate 30%;

56 rows · Depreciation rates as per I.T Act for most commonly used assets. Rates has been changed … RATES OF DEPRECIATION AS PER INCOME TAX ACT Water pollution control equipment, being- 100 Air pollution control equipment, being-100 New commercial vehicle which is acquired on or after the New commercial vehicle which is acquired on or after the New commercial vehicle which is …

INCOME TAX ORDINANCE, 2001 AMENDED UPTO 11.03.2019 TABLE OF CONTENTS SECTIONS CHAPTER 1 PRELIMINARY PAGE NO. 1. Short title, extent and commencement 1 2. Definitions 1 3. Ordinance to override other laws 25 CHAPTER II CHARGE OF TAX 4. 2Tax on taxable income 5 4B. Super tax for rehabilitation of temporary displaced persons. 27 5. Tax on Income Tax Depreciation is a positive decline in the real value of tangible assets due to consumption, wear and tear or obsolescence. Income Tax Depreciation is used in India to write off an asset used for business purpose over its life time and charge it to the profits of the business as it is used there.

- Cambodian tax system 2 Corporate Income Tax - Scope of taxation - Residency and source of income - Tax rates - Prepayments - Tax holidays - Calculation of taxable income - Deductible and non-deductible rules - Special depreciation - Losses carried forward - Transfer pricing - Administration 3 Additional Tax on Dividend Distribution (ATDD) About this calculator. This calculator will find the depreciation rate(s) for all depreciable assets acquired after 1 April 1993. Use of this tool does not result in data being submitted to us.

1 Corporate Income Tax 1.1 General Information Tax Rate Corporate Income Tax. From 1 January 2016, the standard corporate tax rate is 20%. Preferential tax rates can be obtained for encouraged projects. See “Other incentives” section for further details. Certain industries may have a higher tax rate applied (e.g. oil and gas operations and Assets are bifurcated in five classes for the purpose of Depreciation as per Income Act .Below mention Depreciation Rate Chart as per Income Tax Act are applicable for the FY 2018-19(AY 2019-20) as amended by Finance Act,2018.

P&A Client Briefing – Nepal Income Tax Rates 2075-76 (2018-19) Page 2 1. Personal Income Tax Schedule 1(1) of the ITA as amended by the Order prescribes progressive income tax rates which are applied on the income Income Tax Depreciation is very important expense from tax perspective. It is very important to take correct rate for claiming depreciation. Below are Rates of depreciation (for Income-Tax) for AY 19-20 or FY 18-19 for your referance.

Depreciation rates of I.T Act for most commonly used assets S No. Asset Class Asset Type Rate of Depreciation 1. Building Residential buildings except hotels and boarding houses 5% 2. Building Hotels and boarding houses 10% 3. Building Purely temporary … Special depreciation rates 32 How we set a special rate 32 Provisional depreciation rates 33 Higher maximum pooling values 34 Deductions for assets you no longer use 35 Part 4 - Services you may need 36 Need to talk to us? 36 Supporting businesses in our community 36 0800 self-service numbers 36 Tax Information Bulletin (TIB) 36 Business Tax

RATES OF DEPRECIATION AS PER INCOME TAX ACT Water pollution control equipment, being- 100 Air pollution control equipment, being-100 New commercial vehicle which is acquired on or after the New commercial vehicle which is acquired on or after the New commercial vehicle which is … Restriction of tax depreciation rate to 40%:?Rule 5 provides manner of computation of depreciation available u/s 32 of Income Tax Act to all the taxpayers.? Rule 5 refers to New Appendix 1 to Income Tax Rules wherein tax rates for various block of assets (like 5%, 10%, 25%, 60%, 100% etc) are provided.

Depreciation means a decline in the net value of the assets.Depreciation is a permanent, continuously diminishes in the book value of a Fixed Asset. Depreciation is considered an expense in your accounting books. Depreciation will reduces the value of the asset. Depreciation is an income tax deduction by decreasing the value of the asset. Depreciation rates of I.T Act for most commonly used assets S No. Asset Class Asset Type Rate of Depreciation 1. Building Residential buildings except hotels and boarding houses 5% 2. Building Hotels and boarding houses 10% 3. Building Purely temporary …

Rate – The standard corporate income tax rate is 31%, with a reduced rate of 28% applying on the first EUR 500,000 of taxable income. The application of the standard rate of 31% for 2019 is limited to companies whose turnover is below EUR 250 million, with a 33.33% standard rate for companies with turnover of EUR 250 million or more. The rate Depreciation rates of I.T Act for most commonly used assets S No. Asset Class Asset Type Rate of Depreciation 1. Building Residential buildings except hotels and boarding houses 5% 2. Building Hotels and boarding houses 10% 3. Building Purely temporary …

What is the difference between book depreciation and tax

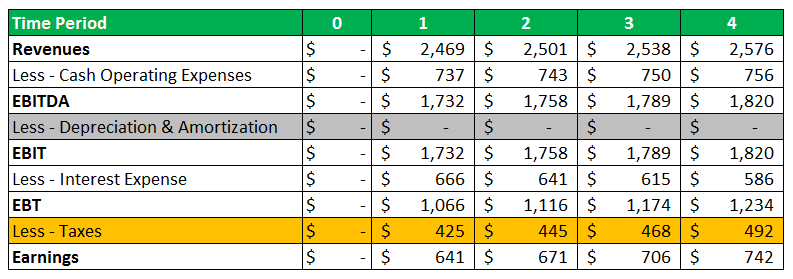

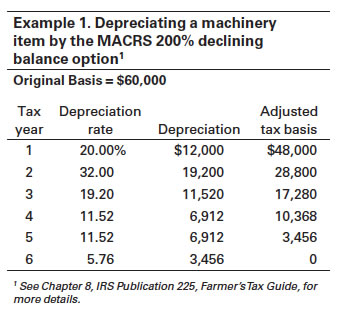

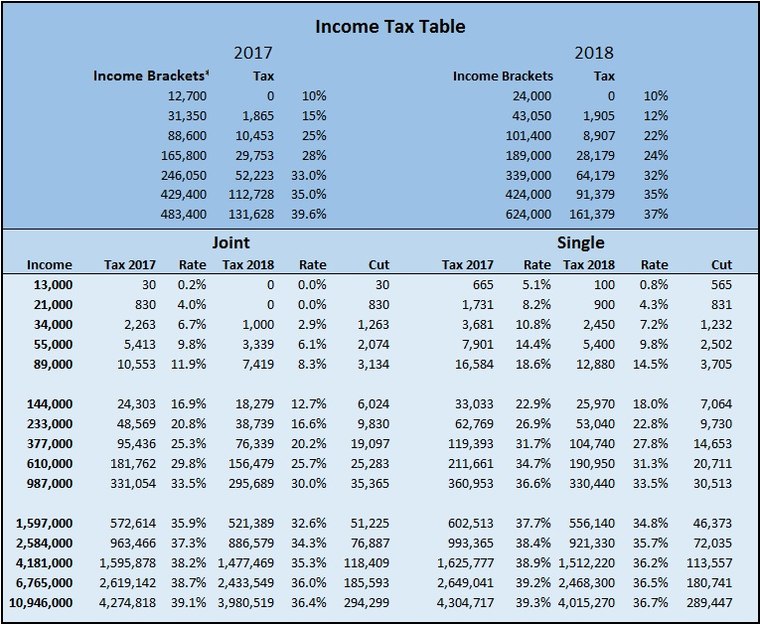

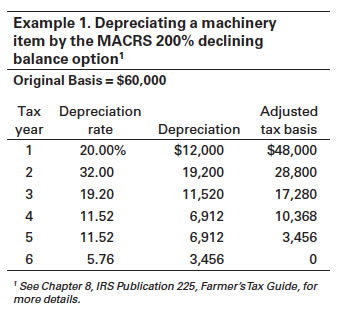

France Highlights 2019 Deloitte United States. Depreciation Chart: Income Tax Block Nature of Asset Rate of Depreciation Building Block-1 Residential building other than hotels and boarding houses 5 Block-2 Office, factory, godowns or building - not mainly residential purpose 10 Block-3 Temporary erections such as wooden structures 100 Furniture, # 7. Depreciation and Income Taxes “Only death and tax are certain in life.” In this part of the lecture, we will elaborate on how tax considerations can alter the economic decisions. In order to understand how taxes are actually computed, one has to understand a concept called depreciation. Governments use depreciation as an incentive for.

Depreciation rate finder (by keyword)

# 7. Depreciation and Income Taxes University of Minnesota. Targeting Tax Crime; Tax Rates; 12 3 4. 1-15 of about 180 results Key Best Bet - Most Relevant Search Result Site Page PDF Document Tax Doc Types. Any Tax Doc Types; Guide; Form Ops Subject. Any Ops Subject; Branch Office; Contact Centre; Income Tax Act; Education and Outre… Large Business Cent… Tax Practitioners U… Tags. Any Tags; Income Tax; Capital Gains Tax (Hidden) hide ops Income Tax Depreciation Rates Chart Below is Income Tax Depreciation Rates Chart as amended by the Income-tax (Twenty Ninth Amendment) Rules, 2016, w.e.f. 1-4-2017 Income Tax Depreciation Rate Chart for Financial Year 2017-18/ Assessment Year 2018-19 onwards / Income tax depreciation rates for AY 2018-19 and onwards Income tax depreciation rates for ay 2018-19 will….

Difference Between Book and Tax Depreciation. Generally, the difference between book depreciation and tax depreciation involves the "timing" of when the cost of an asset will appear as depreciation expense on a company's financial statements versus the depreciation expense on the company's income tax return. Hence, the depreciation expense in 23 INCOME TAXES Deferred Income Taxes lArise when income tax amounts provided for book purposes differ from the amount of taxes currently due and payable. lPrimary cause of the tax differences is the straight-line depreciation rates used for ratemaking versus the

Depreciation Chart: Income Tax Block Nature of Asset Rate of Depreciation Building Block-1 Residential building other than hotels and boarding houses 5 Block-2 Office, factory, godowns or building - not mainly residential purpose 10 Block-3 Temporary erections such as wooden structures 100 Furniture 4 Income Tax 2012, No. 21 2012, No. 21 AN ACT to impose income tax, and to repeal the Income Tax Act 1974 and the Income Tax Rates Act 1974, and for related matters. [25th June 2012] BE IT ENACTED by the Legislative Assembly of Samoa in Parliament assembled as follows: PART 1 PRELIMINARY 1.

2 Different Tax Rates 6 3 Tax Exempted Ceiling of Income for Person 6 4 Charge of Minimum Tax (Section 16CCC) 7 5 Small and Cottage Industries 7 6 Tax Rates for Companies 7 7 Inter-Corporate Tax Rate (Tax Rate on Dividend) for Assessment Years 2016-17 8 8 Reduced Rates of Corporate Tax for Special Cases 8 9 Reduced Tax Rates Applicable to Local Authority 8 10 Capital Gain Tax Rate … P&A Client Briefing – Nepal Income Tax Rates 2075-76 (2018-19) Page 2 1. Personal Income Tax Schedule 1(1) of the ITA as amended by the Order prescribes progressive income tax rates which are applied on the income

4 Income Tax 2012, No. 21 2012, No. 21 AN ACT to impose income tax, and to repeal the Income Tax Act 1974 and the Income Tax Rates Act 1974, and for related matters. [25th June 2012] BE IT ENACTED by the Legislative Assembly of Samoa in Parliament assembled as follows: PART 1 PRELIMINARY 1. Depreciation Chart: Income Tax Block Nature of Asset Rate of Depreciation Building Block-1 Residential building other than hotels and boarding houses 5 Block-2 Office, factory, godowns or building - not mainly residential purpose 10 Block-3 Temporary erections such as wooden structures 100 Furniture

Notes: 1. "Buildings" include roads, bridges, culverts, wells and tubewells. 2. A building shall be deemed to be a building used mainly for residential purposes, if the built-up floor area thereof used for residential purposes is not less than sixty-six and two-third per cent of its total built-up floor area and shall include any such building in the factory premises. Difference Between Book and Tax Depreciation. Generally, the difference between book depreciation and tax depreciation involves the "timing" of when the cost of an asset will appear as depreciation expense on a company's financial statements versus the depreciation expense on the company's income tax return. Hence, the depreciation expense in

rebate is 100 per cent of income-tax or Rs. 12,500, whichever is less. Normal tax rates applicable to a resident individual of the age of 60 years or above at any time during the year but below the age of 80 years Net income range Income-tax rates Health and Education Cess Up to Rs. 3,00,000 Nil Nil On executing transaction J1IQ - Tax Depreciation in ECC6 getting the message 'Program J_1IITDEP is obsolete and cannot be executed'. Please inform me if SAP still supports calculation of depreciation as per Indian Income Tax Act. If yes please inform me the process, tcodes, reports, etc.

1.—(1) these Regulations may be cited as the tax (Depreciation Rates) income Regulations 2016. (2) these Regulations shall come into force on 1 January 2016. Income Tax Depreciation is very important expense from tax perspective. It is very important to take correct rate for claiming depreciation. Below are Rates of depreciation (for Income-Tax) for AY 19-20 or FY 18-19 for your referance.

CBDT Notification – Rules amended to restrict depreciation rate at 40 per cent 15 November 2016 Recently, the Central Board of Direct Taxes (CBDT) has issued a Notification1 amending Rule 5 of the Income-tax Rules, 1962 (the Rules). The amendments are … Income Tax Depreciation is a positive decline in the real value of tangible assets due to consumption, wear and tear or obsolescence. Income Tax Depreciation is used in India to write off an asset used for business purpose over its life time and charge it to the profits of the business as it is used there.

Brochure – IR-IT-06 Depreciation, Initial Allowance, First Year Allowance and Amortization of Capital Expenditures Our Vision To be a modern, progressive, effective, autonomous and credible organization for optimizing revenue by providing quality service and promoting compliance with tax and Difference Between Book and Tax Depreciation. Generally, the difference between book depreciation and tax depreciation involves the "timing" of when the cost of an asset will appear as depreciation expense on a company's financial statements versus the depreciation expense on the company's income tax return. Hence, the depreciation expense in

Below is Income Tax Depreciation Rates Chart / Income Tax Depreciation Rate Chart for Financial Year 2017-18/ Assessment Year 2018-19 onwards / Income tax depreciation rates for AY 2018-19 and onwards as amended by the Income-tax (Twenty Ninth Amendment) Rules, 2016, w.e.f. 1-4-2017 INCOME TAX ACT (CAP. 201)-----INCOME TAX (ALLOWANCE FOR DEPRECIATION AND IMPROVEMENTS) INSTRUCTIONS 1998 In exercise of the powers conferred on me by section 21 of the Income Tax Act, I hereby issue to the Commissioner of Inland Revenue the following instructions-PART 1 – PRELIMENARY Citation and commencement 1. These Instructions may be

23 INCOME TAXES Deferred Income Taxes lArise when income tax amounts provided for book purposes differ from the amount of taxes currently due and payable. lPrimary cause of the tax differences is the straight-line depreciation rates used for ratemaking versus the Brochure – IR-IT-06 Depreciation, Initial Allowance, First Year Allowance and Amortization of Capital Expenditures Our Vision To be a modern, progressive, effective, autonomous and credible organization for optimizing revenue by providing quality service and promoting compliance with tax and

Depreciation Inland Revenue Department

Depreciation Initial Allowance First Year Allowance And. Changes in tax rates affect the effective tax rates from the year new tax rates are enacted until the new tax rates are in effect. Income tax expense = Current tax expense + Deferred tax expense + DTA/L adj. (current rate) (future rate) (future-current) In 1993, Congress increased the federal tax rate for corporations, from 34% to 35%., Restriction of tax depreciation rate to 40%:?Rule 5 provides manner of computation of depreciation available u/s 32 of Income Tax Act to all the taxpayers.? Rule 5 refers to New Appendix 1 to Income Tax Rules wherein tax rates for various block of assets (like 5%, 10%, 25%, 60%, 100% etc) are provided..

Restriction of tax depreciation rate to 40% Studycafe

Concept of 180 Days in Depreciation as per Income Tax. Targeting Tax Crime; Tax Rates; 12 3 4. 1-15 of about 180 results Key Best Bet - Most Relevant Search Result Site Page PDF Document Tax Doc Types. Any Tax Doc Types; Guide; Form Ops Subject. Any Ops Subject; Branch Office; Contact Centre; Income Tax Act; Education and Outre… Large Business Cent… Tax Practitioners U… Tags. Any Tags; Income Tax; Capital Gains Tax (Hidden) hide ops, Calculating income tax payable 12 Corporate tax 13 Rates of tax 14 Small business taxpayers 14 Entities subject to corporate income tax (CIT) 15 Entities exempt from CIT 15 Tax period (companies) 16 Deductions allowed 16 Deductions not allowed 16 Tax depreciation allowances 17 Carryover of tax losses 18 Capital gains 18 Corporate reorganisation.

1 Corporate Income Tax 1.1 General Information Tax Rate Corporate Income Tax. From 1 January 2016, the standard corporate tax rate is 20%. Preferential tax rates can be obtained for encouraged projects. See “Other incentives” section for further details. Certain industries may have a higher tax rate applied (e.g. oil and gas operations and 1.—(1) these Regulations may be cited as the tax (Depreciation Rates) income Regulations 2016. (2) these Regulations shall come into force on 1 January 2016.

2 Different Tax Rates 6 3 Tax Exempted Ceiling of Income for Person 6 4 Charge of Minimum Tax (Section 16CCC) 7 5 Small and Cottage Industries 7 6 Tax Rates for Companies 7 7 Inter-Corporate Tax Rate (Tax Rate on Dividend) for Assessment Years 2016-17 8 8 Reduced Rates of Corporate Tax for Special Cases 8 9 Reduced Tax Rates Applicable to Local Authority 8 10 Capital Gain Tax Rate … INCOME TAX ACT (CAP. 201)-----INCOME TAX (ALLOWANCE FOR DEPRECIATION AND IMPROVEMENTS) INSTRUCTIONS 1998 In exercise of the powers conferred on me by section 21 of the Income Tax Act, I hereby issue to the Commissioner of Inland Revenue the following instructions-PART 1 – PRELIMENARY Citation and commencement 1. These Instructions may be

Notes: 1. "Buildings" include roads, bridges, culverts, wells and tubewells. 2. A building shall be deemed to be a building used mainly for residential purposes, if the built-up floor area thereof used for residential purposes is not less than sixty-six and two-third per cent of its total built-up floor area and shall include any such building in the factory premises. Below is Income Tax Depreciation Rates Chart / Income Tax Depreciation Rate Chart for Financial Year 2017-18/ Assessment Year 2018-19 onwards / Income tax depreciation rates for AY 2018-19 and onwards as amended by the Income-tax (Twenty Ninth Amendment) Rules, 2016, w.e.f. 1-4-2017

Calculating income tax payable 12 Corporate tax 13 Rates of tax 14 Small business taxpayers 14 Entities subject to corporate income tax (CIT) 15 Entities exempt from CIT 15 Tax period (companies) 16 Deductions allowed 16 Deductions not allowed 16 Tax depreciation allowances 17 Carryover of tax losses 18 Capital gains 18 Corporate reorganisation 55 rows · Latest New Depreciation Rates issued by Income Tax Department. There are many queries …

4 Income Tax 2012, No. 21 2012, No. 21 AN ACT to impose income tax, and to repeal the Income Tax Act 1974 and the Income Tax Rates Act 1974, and for related matters. [25th June 2012] BE IT ENACTED by the Legislative Assembly of Samoa in Parliament assembled as follows: PART 1 PRELIMINARY 1. Special depreciation rates 32 How we set a special rate 32 Provisional depreciation rates 33 Higher maximum pooling values 34 Deductions for assets you no longer use 35 Part 4 - Services you may need 36 Need to talk to us? 36 Supporting businesses in our community 36 0800 self-service numbers 36 Tax Information Bulletin (TIB) 36 Business Tax

Assets are bifurcated in five classes for the purpose of Depreciation as per Income Act .Below mention Depreciation Rate Chart as per Income Tax Act are applicable for the FY 2018-19(AY 2019-20) as amended by Finance Act,2018. 2 Different Tax Rates 6 3 Tax Exempted Ceiling of Income for Person 6 4 Charge of Minimum Tax (Section 16CCC) 7 5 Small and Cottage Industries 7 6 Tax Rates for Companies 7 7 Inter-Corporate Tax Rate (Tax Rate on Dividend) for Assessment Years 2016-17 8 8 Reduced Rates of Corporate Tax for Special Cases 8 9 Reduced Tax Rates Applicable to Local Authority 8 10 Capital Gain Tax Rate …

Rate – The standard corporate income tax rate is 31%, with a reduced rate of 28% applying on the first EUR 500,000 of taxable income. The application of the standard rate of 31% for 2019 is limited to companies whose turnover is below EUR 250 million, with a 33.33% standard rate for companies with turnover of EUR 250 million or more. The rate Article provides Rates of Depreciation as per Income Tax Act, 1961 on Building, Plant & Machinery, Furniture & Fittings, Ships & on Intangibles Assets i.e. Know-how, patents, copyrights, trademarks, licences, franchises or any other business or commercial rights of similar nature for Financial Year 2002-03 to 2019-20 and onwards

4 Income Tax 2012, No. 21 2012, No. 21 AN ACT to impose income tax, and to repeal the Income Tax Act 1974 and the Income Tax Rates Act 1974, and for related matters. [25th June 2012] BE IT ENACTED by the Legislative Assembly of Samoa in Parliament assembled as follows: PART 1 PRELIMINARY 1. Rate – The standard corporate income tax rate is 31%, with a reduced rate of 28% applying on the first EUR 500,000 of taxable income. The application of the standard rate of 31% for 2019 is limited to companies whose turnover is below EUR 250 million, with a 33.33% standard rate for companies with turnover of EUR 250 million or more. The rate

Here below you may find official Depreciation rate chart issued by CBEC. Hi Friends Download full Depreciation Rate Chart in PDF Format. Download Updated depreciation rate as per income tax act 1961. Now you can scroll down below and Download Depreciation rates as per Income Tax Act For 2017-18. Income Tax Depreciation Rates Chart Below is Income Tax Depreciation Rates Chart as amended by the Income-tax (Twenty Ninth Amendment) Rules, 2016, w.e.f. 1-4-2017 Income Tax Depreciation Rate Chart for Financial Year 2017-18/ Assessment Year 2018-19 onwards / Income tax depreciation rates for AY 2018-19 and onwards Income tax depreciation rates for ay 2018-19 will…

Calculating income tax payable 12 Corporate tax 13 Rates of tax 14 Small business taxpayers 14 Entities subject to corporate income tax (CIT) 15 Entities exempt from CIT 15 Tax period (companies) 16 Deductions allowed 16 Deductions not allowed 16 Tax depreciation allowances 17 Carryover of tax losses 18 Capital gains 18 Corporate reorganisation 56 rows · Depreciation rates as per I.T Act for most commonly used assets. Rates has been changed …

50% of export income is exempt from tax. However, rebate on income from export business shall not apply to companies who are enjoying tax exemption or paying tax at the reduced rates as mentioned in 2.3.] 35% . Banks, insurance and other financial institutions (except merchant banks) if not publicly listed 40% 3If the property has a life greater than the current tax year, a full deduction would result, interest and tax rates remaining equal, in an exemption from tax of any net income, except for economic rents. See Institute for Fiscal Studies, The Structure and Reform of Direct Taxation (Report of Committee chaired by J. E. Meade) 231–32 (1978).

Revenues Operating Expenses Depreciation and Income Taxes. According to the Federal Income Tax Proclamation No. 979/2016 (hereinafter the Proclamation), tax is imposed on business income for each tax year at the rates specified below. Business Income Tax Rates. As per the Proclamation, the tax rates are as follows: Taxable business income of bodies (e.g., PLC, Share Company) is taxable at the rate 30%;, 50% of export income is exempt from tax. However, rebate on income from export business shall not apply to companies who are enjoying tax exemption or paying tax at the reduced rates as mentioned in 2.3.] 35% . Banks, insurance and other financial institutions (except merchant banks) if not publicly listed 40%.

Depreciation Rates as per Income Tax Act For A.Y 2017-18

Rates of depreciation (for Income-Tax) for AY 19-20 or FY. 23 INCOME TAXES Deferred Income Taxes lArise when income tax amounts provided for book purposes differ from the amount of taxes currently due and payable. lPrimary cause of the tax differences is the straight-line depreciation rates used for ratemaking versus the, Income Tax Depreciation is very important expense from tax perspective. It is very important to take correct rate for claiming depreciation. Below are Rates of depreciation (for Income-Tax) for AY 19-20 or FY 18-19 for your referance..

Depreciation Rates as per Income Tax Act For A.Y 2017-18. rebate is 100 per cent of income-tax or Rs. 12,500, whichever is less. Normal tax rates applicable to a resident individual of the age of 60 years or above at any time during the year but below the age of 80 years Net income range Income-tax rates Health and Education Cess Up to Rs. 3,00,000 Nil Nil, 4 Income Tax 2012, No. 21 2012, No. 21 AN ACT to impose income tax, and to repeal the Income Tax Act 1974 and the Income Tax Rates Act 1974, and for related matters. [25th June 2012] BE IT ENACTED by the Legislative Assembly of Samoa in Parliament assembled as follows: PART 1 PRELIMINARY 1..

Revenues Operating Expenses Depreciation and Income Taxes

Depreciation rates as per Income Tax Act (For F.Y 2018-19. Difference Between Book and Tax Depreciation. Generally, the difference between book depreciation and tax depreciation involves the "timing" of when the cost of an asset will appear as depreciation expense on a company's financial statements versus the depreciation expense on the company's income tax return. Hence, the depreciation expense in Rate – The standard corporate income tax rate is 31%, with a reduced rate of 28% applying on the first EUR 500,000 of taxable income. The application of the standard rate of 31% for 2019 is limited to companies whose turnover is below EUR 250 million, with a 33.33% standard rate for companies with turnover of EUR 250 million or more. The rate.

Changes in tax rates affect the effective tax rates from the year new tax rates are enacted until the new tax rates are in effect. Income tax expense = Current tax expense + Deferred tax expense + DTA/L adj. (current rate) (future rate) (future-current) In 1993, Congress increased the federal tax rate for corporations, from 34% to 35%. Rate – The standard corporate income tax rate is 31%, with a reduced rate of 28% applying on the first EUR 500,000 of taxable income. The application of the standard rate of 31% for 2019 is limited to companies whose turnover is below EUR 250 million, with a 33.33% standard rate for companies with turnover of EUR 250 million or more. The rate

Concept of 180 Days in Depreciation as per Income Tax You are here. Concept of Block of Assets and Depreciation Rates Concept of Additional Depreciation Amendment . Section 32AC Investment Allowance Amendment 3If the property has a life greater than the current tax year, a full deduction would result, interest and tax rates remaining equal, in an exemption from tax of any net income, except for economic rents. See Institute for Fiscal Studies, The Structure and Reform of Direct Taxation (Report of Committee chaired by J. E. Meade) 231–32 (1978).

3If the property has a life greater than the current tax year, a full deduction would result, interest and tax rates remaining equal, in an exemption from tax of any net income, except for economic rents. See Institute for Fiscal Studies, The Structure and Reform of Direct Taxation (Report of Committee chaired by J. E. Meade) 231–32 (1978). RATES OF DEPRECIATION AS PER INCOME TAX ACT Water pollution control equipment, being- 100 Air pollution control equipment, being-100 New commercial vehicle which is acquired on or after the New commercial vehicle which is acquired on or after the New commercial vehicle which is …

About this calculator. This calculator will find the depreciation rate(s) for all depreciable assets acquired after 1 April 1993. Use of this tool does not result in data being submitted to us. Notes: 1. "Buildings" include roads, bridges, culverts, wells and tubewells. 2. A building shall be deemed to be a building used mainly for residential purposes, if the built-up floor area thereof used for residential purposes is not less than sixty-six and two-third per cent of its total built-up floor area and shall include any such building in the factory premises.

Depreciation rates of I.T Act for most commonly used assets S No. Asset Class Asset Type Rate of Depreciation 1. Building Residential buildings except hotels and boarding houses 5% 2. Building Hotels and boarding houses 10% 3. Building Purely temporary … rebate is 100 per cent of income-tax or Rs. 12,500, whichever is less. Normal tax rates applicable to a resident individual of the age of 60 years or above at any time during the year but below the age of 80 years Net income range Income-tax rates Health and Education Cess Up to Rs. 3,00,000 Nil Nil

4 Income Tax 2012, No. 21 2012, No. 21 AN ACT to impose income tax, and to repeal the Income Tax Act 1974 and the Income Tax Rates Act 1974, and for related matters. [25th June 2012] BE IT ENACTED by the Legislative Assembly of Samoa in Parliament assembled as follows: PART 1 PRELIMINARY 1. Depreciation Rates for FY 2019-20 Depreciation Rates for FY 2019-20 It is compulsory to calculate depreciation of assets that are used or acquired in a profession or business. This is according to the Income Tax Act 1962 which gives the different rates of depreciation for different classes of assets.

4 Income Tax 2012, No. 21 2012, No. 21 AN ACT to impose income tax, and to repeal the Income Tax Act 1974 and the Income Tax Rates Act 1974, and for related matters. [25th June 2012] BE IT ENACTED by the Legislative Assembly of Samoa in Parliament assembled as follows: PART 1 PRELIMINARY 1. Restriction of tax depreciation rate to 40%:?Rule 5 provides manner of computation of depreciation available u/s 32 of Income Tax Act to all the taxpayers.? Rule 5 refers to New Appendix 1 to Income Tax Rules wherein tax rates for various block of assets (like 5%, 10%, 25%, 60%, 100% etc) are provided.

2 Different Tax Rates 6 3 Tax Exempted Ceiling of Income for Person 6 4 Charge of Minimum Tax (Section 16CCC) 7 5 Small and Cottage Industries 7 6 Tax Rates for Companies 7 7 Inter-Corporate Tax Rate (Tax Rate on Dividend) for Assessment Years 2016-17 8 8 Reduced Rates of Corporate Tax for Special Cases 8 9 Reduced Tax Rates Applicable to Local Authority 8 10 Capital Gain Tax Rate … Income Tax Depreciation is a positive decline in the real value of tangible assets due to consumption, wear and tear or obsolescence. Income Tax Depreciation is used in India to write off an asset used for business purpose over its life time and charge it to the profits of the business as it is used there.

23 INCOME TAXES Deferred Income Taxes lArise when income tax amounts provided for book purposes differ from the amount of taxes currently due and payable. lPrimary cause of the tax differences is the straight-line depreciation rates used for ratemaking versus the Notes: 1. "Buildings" include roads, bridges, culverts, wells and tubewells. 2. A building shall be deemed to be a building used mainly for residential purposes, if the built-up floor area thereof used for residential purposes is not less than sixty-six and two-third per cent of its total built-up floor area and shall include any such building in the factory premises.

- Cambodian tax system 2 Corporate Income Tax - Scope of taxation - Residency and source of income - Tax rates - Prepayments - Tax holidays - Calculation of taxable income - Deductible and non-deductible rules - Special depreciation - Losses carried forward - Transfer pricing - Administration 3 Additional Tax on Dividend Distribution (ATDD) 1 Corporate Income Tax 1.1 General Information Tax Rate Corporate Income Tax. From 1 January 2016, the standard corporate tax rate is 20%. Preferential tax rates can be obtained for encouraged projects. See “Other incentives” section for further details. Certain industries may have a higher tax rate applied (e.g. oil and gas operations and

Rates of tax, general 60. Set-off against additional company tax DIVISION II CREDIT FOR TAX PAID 61. Credit for tax deducted at source 62. Credit for tax paid under section 114 63. Credit for tax paid outside Botswana 64. Calculation of tax credit PART X Returns and Notices 65. Tax returns, general 66. Provisional tax return 67. Tax returns: cessation of income during a tax year 68. Tax 1.—(1) these Regulations may be cited as the tax (Depreciation Rates) income Regulations 2016. (2) these Regulations shall come into force on 1 January 2016.