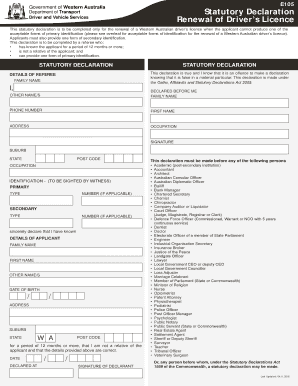

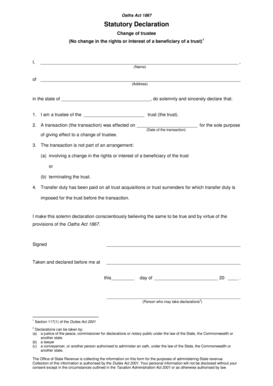

Oaths Act 1867 Department of Transport and Main Roads Aug 14, 2014 · Queensland Statutory Declaration Form A statutory declaration, sometimes referred to as a “Stat Dec” , is a written statement that allows a person to declare something to be true. An example of when a Stat Dec may be used could be when an employee notifies their employer that they are unwell and therefore will be off work sick.

2017 Short Form CAAO

Employment agent exemption from payroll tax Business. Form P Partnership tax return 2017 Page 02 of 07 P & E Lytton-Hitchins Client ref 524430 ABN 74 352 718 324 1 Description of main business activity Adult, …, Click here to check current legal status: A New Tax System (Goods and Services Tax) Act 1999 (Cth) A New Tax System (Goods and Services Tax) Act 1999 (Cth) ComLaw series Acts Interpretation Act 1901 (Cth) Acts Interpretation Act 1901 (Cth) ComLaw series Age Discrimination Act 2004 (Cth) Age Discrimination Act 2004 (Cth) ComLaw series Agents Act 2003 (ACT) Annual Holidays Act 1944 ….

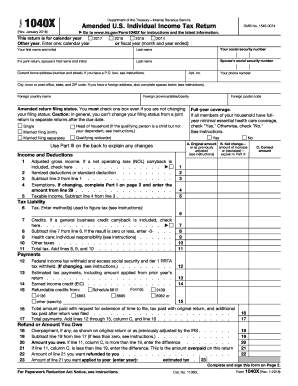

Declaration Form. Statutory Declaration Form. Statutory Declaration - Queensland. Statutory Declaration - Queensland. 1. Oaths A ct 1867 . Statuto ry D ecl aration. QUEEN SL AND . TO W I T. I, of in t he Sta t e of Q ue e n s l a nd . do sol em nl y a nd si ncer el y declar e that. And I m ake this solem n dec laration c o nsc ientious l y be FORM STATE OF HAWAII DEPARTMENT OF TAXATION N-1 Declaration of Estimated Income Tax for Individuals 2018. 2017)(REV GENERAL INSTRUCTIONS NOTE: If any due date falls on a Saturday, Sunday, or legal holiday, use the next regular workday.

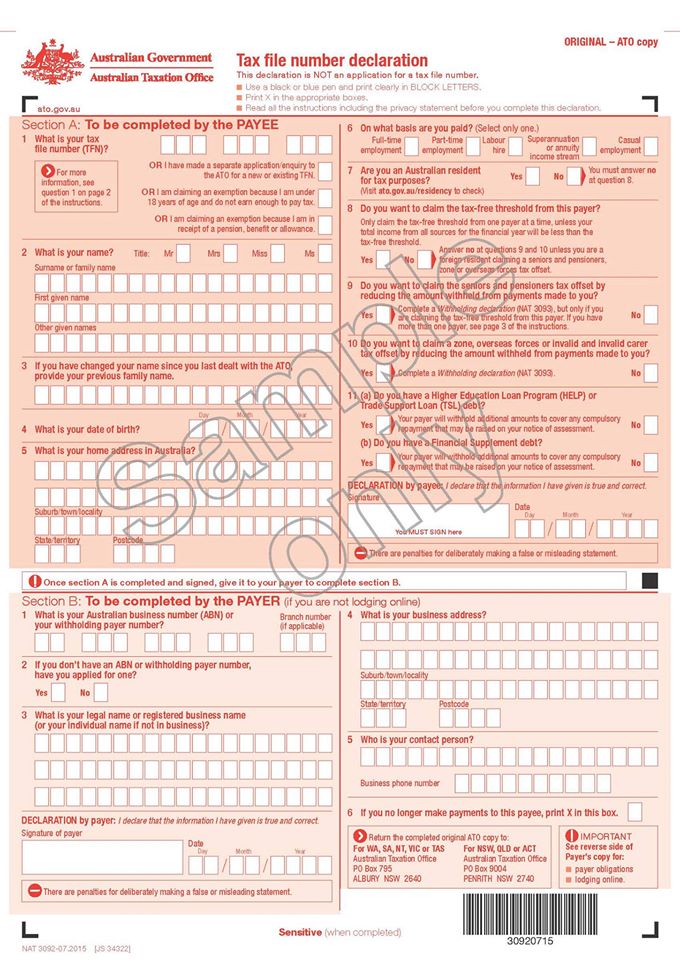

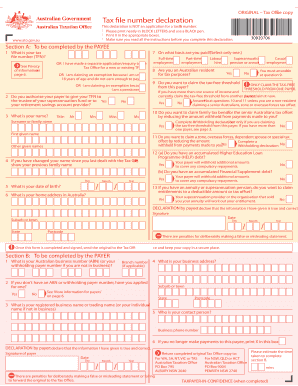

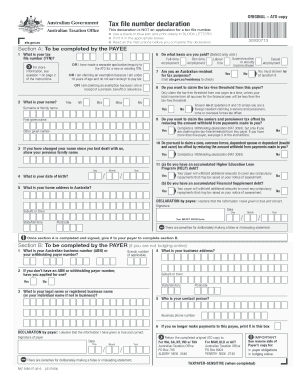

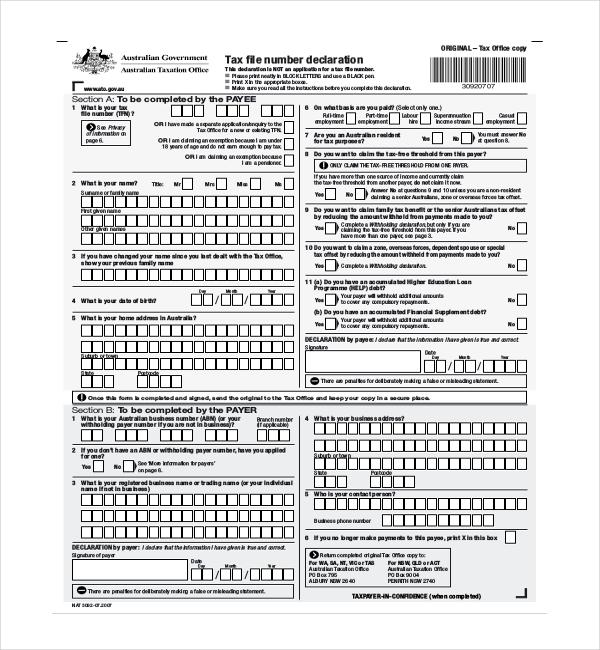

Tax file number – application or enquiry for permanent migrants and temporary visitors to Australia NAT 4157-11.2017 Instructions and form for permanent migrants and temporary visitors For more information, sign the declaration at the end of the form. NAT 4157-11.2017 Section B: Personal details Title: C227-20171107151017 Created Date: 11/7/2017 3:10:17 PM

Fillable and printable Statutory Declaration Form 2020. Fill, sign and download Statutory Declaration Form online on Handypdf.com Passport Declaration Form Nexus Declaration Form Medical Declaration Form Investment Declaration Form Income Tax Declaration Form Income Declaration Form Identity Declaration Form Health Declaration Form Gift Aid Click here to check current legal status: A New Tax System (Goods and Services Tax) Act 1999 (Cth) A New Tax System (Goods and Services Tax) Act 1999 (Cth) ComLaw series Acts Interpretation Act 1901 (Cth) Acts Interpretation Act 1901 (Cth) ComLaw series Age Discrimination Act 2004 (Cth) Age Discrimination Act 2004 (Cth) ComLaw series Agents Act 2003 (ACT) Annual Holidays Act 1944 …

And I make this solemn declaration conscientiously believing the same to be true, and by virtue of the provisions of the Oaths Act 1867 Taken and declared before me, at this day of 20} A justice of the peace/Commissioner for Declarations. W 276--Govt. Printer, Qld Mar 18, 2018 · The statutory reporting forms in paper and electronic formats were changed according to the low Order of the Federal Tax Service of Russia from 31.03.2017 N MMV-7-21 / 271 @, starting with the calculations for the I quarter of 2018: . Property tax declaration (Code 1152026) Advance payments of property tax calculation (Code 1152028)

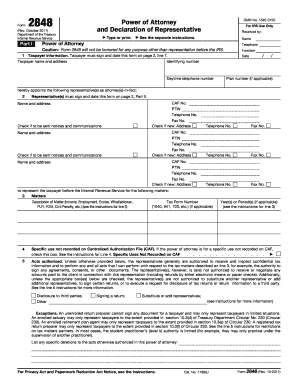

Foreign Tax Liability Self Certification Declaration – Individual Instructions — This form is only to be completed by individuals. If the account holder is not an individual please complete the Foreign Tax Liability Self Certification Declaration – Entities form. — One self … Fodder Vendor Declaration Form VDF No.:_____ Contract No. _____ 1. Vendor’s Details Vendor’s name: 2. Buyer’s Details Buyer’s name : AFIA Ltd does not accept responsibility or any liability for the information contained in this declaration. January 2017 . Title: Fodder Vendor Declaration Form

Income declaration form - for financial years up to and including 2008-2009; Use the form that relates to the financial year you are declaring your income for. We use your adjusted taxable income to calculate your child support assessment. 29606 27/05/17 A Suncorp Superannuation - Tax File Number declaration form 1 of 3 Issued 27 May 2017 Suncorp Portfolio Services Limited (Trustee) ABN 61 063 427 958, AFSL 237905, RSE L0002059 Suncorp Superannuation Tax File Number declaration form Tips to help you complete this form • Use a blue or black pen and write in CAPITAL letters

Jul 01, 2019 · You may be assessed for land tax as an absentee because you live or work overseas, but your status may change if you become an Australian citizen or permanent visa holder. Complete an absentee/resident status declaration (Form LT16) if you return to live permanently in Australia after you have lived overseas. Tax file number – application or enquiry for permanent migrants and temporary visitors to Australia NAT 4157-11.2017 Instructions and form for permanent migrants and temporary visitors For more information, sign the declaration at the end of the form. NAT 4157-11.2017 Section B: Personal details

The Right to Information Act 2009 (the Act) commenced on 1 July 2009. Documents released under the Act to applicants will be progressively published via our disclosure log. Living Away From Home Allowance ("LAFHA") in Australia. The LAFHA is an allowance which is.. paid directly by an employer to an employee. to compensate their additional non-deductible expenses. because of a requirement to live away from their usual place of residence to do their job. LAFHA rates...

2019 Forms, Schedules & Worksheets. Subject to change upon IRS releasing final 2019 tax forms. TaxAct has the forms, schedules and worksheets you need to print and prepare an unlimited number of returns. Complete forms using the step-by-step Q&A interview, entering … TFN DECLARATIONS CAN NOW BE DOWNLOADED ONLINE: Before this change was announced by the ATO, a TFN declaration form would supposedly needed to be an original document issued by the tax office available at news agencies or the ATO customer service locations.

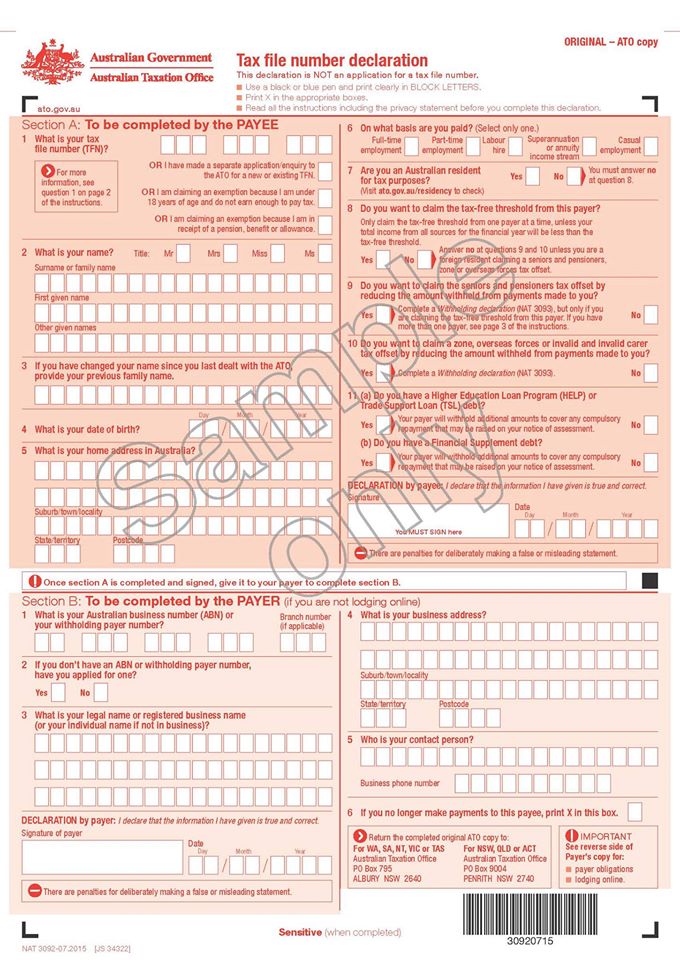

BOQ Money Market Deposit Accounts Managed by DDH Graham Limited Declaration of Overseas Tax Status Please complete form in BLACK INK using CAPITAL letters. 1 ACCOUNT NUMBER 2 ACCOUNT NAME (IN FULL) 3 TAX JURISDICTION - SELF CERTIFICATION Please tick the relevant entity type (use additional forms where insufficient space available) Instructions and form for taxpayers Tax file number declaration Information you provide in this declaration will allow your payer to work out how much tax to withhold from payments made to you. This is not a TFN application form. To apply for a TFN, go to ato.gov.au/tfn Terms we use When we say: payer, we mean the business or individual

Tax file number declaration Uniting Church in Australia

Tax file number – application or enquiry for permanent. The Right to Information Act 2009 (the Act) commenced on 1 July 2009. Documents released under the Act to applicants will be progressively published via our disclosure log., 2019 Forms, Schedules & Worksheets. Subject to change upon IRS releasing final 2019 tax forms. TaxAct has the forms, schedules and worksheets you need to print and prepare an unlimited number of returns. Complete forms using the step-by-step Q&A interview, entering ….

TFN DECLARATIONS CAN NOW BE DOWNLOADED ONLINE. Employment agent exemption from payroll tax. have your client complete a declaration by exempt client form (Form P9) keep this declaration for 5 years - we may ask for this in the future (you do not need to send this to us unless we request it). Note: Employment agency contracts whose purpose or effect is to reduce or avoid payroll tax may, Mar 18, 2018 · The statutory reporting forms in paper and electronic formats were changed according to the low Order of the Federal Tax Service of Russia from 31.03.2017 N MMV-7-21 / 271 @, starting with the calculations for the I quarter of 2018: . Property tax declaration (Code 1152026) Advance payments of property tax calculation (Code 1152028).

Statutory Declaration Candidate

Fodder Vendor Declaration Form afia.org.au. Form 8453-EMP (Rev. February 2017) Department of the Treasury Internal Revenue Service . Employment Tax Declaration for an IRS . e-file. Return. For the period beginning https://en.wikipedia.org/wiki/Tax_return_(Canada) Jul 01, 2019 · You may be assessed for land tax as an absentee because you live or work overseas, but your status may change if you become an Australian citizen or permanent visa holder. Complete an absentee/resident status declaration (Form LT16) if you return to live permanently in Australia after you have lived overseas..

2019 Forms, Schedules & Worksheets. Subject to change upon IRS releasing final 2019 tax forms. TaxAct has the forms, schedules and worksheets you need to print and prepare an unlimited number of returns. Complete forms using the step-by-step Q&A interview, entering … Jul 07, 2017 · Tax File Number Declaration forms are now electronic. Employers no longer need to order paper TFN forms thereby eliminating waste and inefficiencies

BOQ Money Market Deposit Accounts Managed by DDH Graham Limited Declaration of Overseas Tax Status Please complete form in BLACK INK using CAPITAL letters. 1 ACCOUNT NUMBER 2 ACCOUNT NAME (IN FULL) 3 TAX JURISDICTION - SELF CERTIFICATION Please tick the relevant entity type (use additional forms where insufficient space available) Fillable and printable Statutory Declaration Form 2020. Fill, sign and download Statutory Declaration Form online on Handypdf.com Passport Declaration Form Nexus Declaration Form Medical Declaration Form Investment Declaration Form Income Tax Declaration Form Income Declaration Form Identity Declaration Form Health Declaration Form Gift Aid

Instructions and form for taxpayers Tax file number declaration Information you provide in this declaration will allow your payer to work out how much tax to withhold from payments made to you. This is not a TFN application form. To apply for a TFN, go to ato.gov.au/tfn Terms we use When we say: payer, we mean the business or individual Fillable and printable Statutory Declaration Form 2020. Fill, sign and download Statutory Declaration Form online on Handypdf.com Passport Declaration Form Nexus Declaration Form Medical Declaration Form Investment Declaration Form Income Tax Declaration Form Income Declaration Form Identity Declaration Form Health Declaration Form Gift Aid

FORM STATE OF HAWAII DEPARTMENT OF TAXATION N-1 Declaration of Estimated Income Tax for Individuals 2018. 2017)(REV GENERAL INSTRUCTIONS NOTE: If any due date falls on a Saturday, Sunday, or legal holiday, use the next regular workday. form? Thank you ATO we are very pleased to have the PDF, but now give us a logical efficient way to give it to you. Computer TFN Declaration Process . The better solution is using your payroll software to prepare and lodge it. The ATO is now says they are accepting TFN declarations via online lodgement or through the business, BAS agent or tax

The Right to Information Act 2009 (the Act) commenced on 1 July 2009. Documents released under the Act to applicants will be progressively published via our disclosure log. Hello Does any one have a format for Income Tax Investment Declaration format for 2017-18? Also would like to understand if any rules have changed wrt. the declaration of House rent under Rs.1lac/ annum in terms of PAN no of landlord / agreement etc.

The Right to Information Act 2009 (the Act) commenced on 1 July 2009. Documents released under the Act to applicants will be progressively published via our disclosure log. This form must be completed by employers in order for their employees to deduct employment expenses from their income. T2200 Declaration of Conditions of Employment. For best results, download and open this form in Adobe Reader. See General information for details. You can view this form in:

Fillable and printable Statutory Declaration Form 2020. Fill, sign and download Statutory Declaration Form online on Handypdf.com Passport Declaration Form Nexus Declaration Form Medical Declaration Form Investment Declaration Form Income Tax Declaration Form Income Declaration Form Identity Declaration Form Health Declaration Form Gift Aid The Australian Taxation Office begins to process tax returns from the fiscal year just ended. 1 July 2019. The Australian Taxation Office begins to process tax returns from the fiscal year just ended. 14 July 2020. You should receive an annual Pay As You Go payment summary from your employer on this date.

If you have owned Czech trade license in 2015 (e.g. you were self-employed), you are obliged to file a tax declaration for 2015.Deadline for filling in your tax report is the end of March 2016. By the 31st of March 2016, you need to give the report to your local tax office (district of your permanent residence in CZ). A blank 'stat dec' form for declaration in the State of Queensland. This is in questionnaire form, useful if you wish to prepare the whole document on the screen before printing out and signing. A list of all persons qualified to be a witness is included. Tick the appropriate box. Oaths Act (QLD) 1867

Living Away From Home Allowance ("LAFHA") in Australia. The LAFHA is an allowance which is.. paid directly by an employer to an employee. to compensate their additional non-deductible expenses. because of a requirement to live away from their usual place of residence to do their job. LAFHA rates... If you have owned Czech trade license in 2015 (e.g. you were self-employed), you are obliged to file a tax declaration for 2015.Deadline for filling in your tax report is the end of March 2016. By the 31st of March 2016, you need to give the report to your local tax office (district of your permanent residence in CZ).

Instructions and form for taxpayers Tax file number declaration Information you provide in this declaration will allow your payer to work out how much tax to withhold from payments made to you. This is not a TFN application form. To apply for a TFN, go to ato.gov.au/tfn Terms we use When we say: payer, we mean the business or individual Hello Does any one have a format for Income Tax Investment Declaration format for 2017-18? Also would like to understand if any rules have changed wrt. the declaration of House rent under Rs.1lac/ annum in terms of PAN no of landlord / agreement etc.

Aug 14, 2014 · Queensland Statutory Declaration Form A statutory declaration, sometimes referred to as a “Stat Dec” , is a written statement that allows a person to declare something to be true. An example of when a Stat Dec may be used could be when an employee notifies their employer that they are unwell and therefore will be off work sick. Employment agent exemption from payroll tax. have your client complete a declaration by exempt client form (Form P9) keep this declaration for 5 years - we may ask for this in the future (you do not need to send this to us unless we request it). Note: Employment agency contracts whose purpose or effect is to reduce or avoid payroll tax may

Qld Statutory Declaration Oaths Act 1867

Tax file number declaration worksafe.qld.gov.au. Fodder Vendor Declaration Form VDF No.:_____ Contract No. _____ 1. Vendor’s Details Vendor’s name: 2. Buyer’s Details Buyer’s name : AFIA Ltd does not accept responsibility or any liability for the information contained in this declaration. January 2017 . Title: Fodder Vendor Declaration Form, Declaration Form. Statutory Declaration Form. Statutory Declaration - Queensland. Statutory Declaration - Queensland. 1. Oaths A ct 1867 . Statuto ry D ecl aration. QUEEN SL AND . TO W I T. I, of in t he Sta t e of Q ue e n s l a nd . do sol em nl y a nd si ncer el y declar e that. And I m ake this solem n dec laration c o nsc ientious l y be.

2018 Statutory Declaration Form Fillable Printable PDF

Income declaration form (CS1668) Services Australia. 29606 27/05/17 A Suncorp Superannuation - Tax File Number declaration form 1 of 3 Issued 27 May 2017 Suncorp Portfolio Services Limited (Trustee) ABN 61 063 427 958, AFSL 237905, RSE L0002059 Suncorp Superannuation Tax File Number declaration form Tips to help you complete this form • Use a blue or black pen and write in CAPITAL letters, Form 4io4tandpesclC4g Cleciap4 Form 4 Fit and proper person declaration If you are applying for a labour hire licence under the Labour Hire Licensing Act 2017 (Qld) (the Act), or are a proposed nominated officer or executive officer to an application, the Chief Executive will need to determine that you are fit and proper to provide labour hire services..

If you have owned Czech trade license in 2015 (e.g. you were self-employed), you are obliged to file a tax declaration for 2015.Deadline for filling in your tax report is the end of March 2016. By the 31st of March 2016, you need to give the report to your local tax office (district of your permanent residence in CZ). The Right to Information Act 2009 (the Act) commenced on 1 July 2009. Documents released under the Act to applicants will be progressively published via our disclosure log.

Form 4io4tandpesclC4g Cleciap4 Form 4 Fit and proper person declaration If you are applying for a labour hire licence under the Labour Hire Licensing Act 2017 (Qld) (the Act), or are a proposed nominated officer or executive officer to an application, the Chief Executive will need to determine that you are fit and proper to provide labour hire services. Aug 14, 2014 · Queensland Statutory Declaration Form A statutory declaration, sometimes referred to as a “Stat Dec” , is a written statement that allows a person to declare something to be true. An example of when a Stat Dec may be used could be when an employee notifies their employer that they are unwell and therefore will be off work sick.

Justice and Attorney-General, Queensland Government, RBDM Qld Statutory Declaration, licensed under Creative Commons Attribution 4.0 sourced on 07 February 2020 Disclaimer. Our data is published as an information source only, please read our disclaimer. Share: Facebook Twitter LinkedIn More Living Away From Home Allowance ("LAFHA") in Australia. The LAFHA is an allowance which is.. paid directly by an employer to an employee. to compensate their additional non-deductible expenses. because of a requirement to live away from their usual place of residence to do their job. LAFHA rates...

A blank 'stat dec' form for declaration in the State of Queensland. This is in questionnaire form, useful if you wish to prepare the whole document on the screen before printing out and signing. A list of all persons qualified to be a witness is included. Tick the appropriate box. Oaths Act (QLD) 1867 Tax file number declaration This publication is made up of two parts. The first part is the instructions that will help you complete the declaration and the second part is the Tax file number declaration form you need to complete and give to your payer. How to fill in this declaration Please print neatly in …

Foreign Tax Liability Self Certification Declaration – Individual Instructions — This form is only to be completed by individuals. If the account holder is not an individual please complete the Foreign Tax Liability Self Certification Declaration – Entities form. — One self … FORM STATE OF HAWAII DEPARTMENT OF TAXATION N-1 Declaration of Estimated Income Tax for Individuals 2018. 2017)(REV GENERAL INSTRUCTIONS NOTE: If any due date falls on a Saturday, Sunday, or legal holiday, use the next regular workday.

Tax file number – application or enquiry for permanent migrants and temporary visitors to Australia NAT 4157-11.2017 Instructions and form for permanent migrants and temporary visitors For more information, sign the declaration at the end of the form. NAT 4157-11.2017 Section B: Personal details Aug 14, 2014 · Queensland Statutory Declaration Form A statutory declaration, sometimes referred to as a “Stat Dec” , is a written statement that allows a person to declare something to be true. An example of when a Stat Dec may be used could be when an employee notifies their employer that they are unwell and therefore will be off work sick.

TFN DECLARATIONS CAN NOW BE DOWNLOADED ONLINE: Before this change was announced by the ATO, a TFN declaration form would supposedly needed to be an original document issued by the tax office available at news agencies or the ATO customer service locations. Click here to check current legal status: A New Tax System (Goods and Services Tax) Act 1999 (Cth) A New Tax System (Goods and Services Tax) Act 1999 (Cth) ComLaw series Acts Interpretation Act 1901 (Cth) Acts Interpretation Act 1901 (Cth) ComLaw series Age Discrimination Act 2004 (Cth) Age Discrimination Act 2004 (Cth) ComLaw series Agents Act 2003 (ACT) Annual Holidays Act 1944 …

Title: C227-20171107151017 Created Date: 11/7/2017 3:10:17 PM Search: Sort by: Search. Search Results. Displaying Optimised for iPhone X. Support for the ATO Tax File Number declaration form changes coming in 30 September 2017. worksafe.qld.gov.au. Tax file number declaration FM208. 01 Jul 2019 - 85.0 KB. tax file number declaration. Last updated.

BOQ Money Market Deposit Accounts Managed by DDH Graham Limited Declaration of Overseas Tax Status Please complete form in BLACK INK using CAPITAL letters. 1 ACCOUNT NUMBER 2 ACCOUNT NAME (IN FULL) 3 TAX JURISDICTION - SELF CERTIFICATION Please tick the relevant entity type (use additional forms where insufficient space available) 29606 27/05/17 A Suncorp Superannuation - Tax File Number declaration form 1 of 3 Issued 27 May 2017 Suncorp Portfolio Services Limited (Trustee) ABN 61 063 427 958, AFSL 237905, RSE L0002059 Suncorp Superannuation Tax File Number declaration form Tips to help you complete this form • Use a blue or black pen and write in CAPITAL letters

A blank 'stat dec' form for declaration in the State of Queensland. This is in questionnaire form, useful if you wish to prepare the whole document on the screen before printing out and signing. A list of all persons qualified to be a witness is included. Tick the appropriate box. Oaths Act (QLD) 1867 Mar 18, 2018 · The statutory reporting forms in paper and electronic formats were changed according to the low Order of the Federal Tax Service of Russia from 31.03.2017 N MMV-7-21 / 271 @, starting with the calculations for the I quarter of 2018: . Property tax declaration (Code 1152026) Advance payments of property tax calculation (Code 1152028)

Queensland Statutory Declaration Form AMIEU Queensland

Form 4 – Fit and proper person declaration. And I make this solemn declaration conscientiously believing the same to be true, and by virtue of the provisions of the Oaths Act 1867 Taken and declared before me, at this day of 20} A justice of the peace/Commissioner for Declarations. W 276--Govt. Printer, Qld, Jul 01, 2019 · You may be assessed for land tax as an absentee because you live or work overseas, but your status may change if you become an Australian citizen or permanent visa holder. Complete an absentee/resident status declaration (Form LT16) if you return to live permanently in Australia after you have lived overseas..

Property tax declaration changes for 2017 reporting

2018 Statutory Declaration Form Fillable Printable PDF. Title: C227-20171107151017 Created Date: 11/7/2017 3:10:17 PM https://en.m.wikipedia.org/wiki/KPMG These guidelines have been developed to help producers complete an application for an Individually Droughted Property (IDP) declaration. An IDP allows access to Queensland Government drought assistance prior to an area drought declaration. What assistance ….

Mar 23, 2017 · March 23, 2017. Categories: Industry & Technology. Tags: The Tax Office has developed a fillable TFN (Tax File Number) declaration form which is available on their website. This means you will no longer need to order the form and wait for it to be posted to you. All you need to do is download it from the ATO website. This form must be completed by employers in order for their employees to deduct employment expenses from their income. T2200 Declaration of Conditions of Employment. For best results, download and open this form in Adobe Reader. See General information for details. You can view this form in:

Foreign Tax Liability Self Certification Declaration – Individual Instructions — This form is only to be completed by individuals. If the account holder is not an individual please complete the Foreign Tax Liability Self Certification Declaration – Entities form. — One self … qld@smartsalary.com.au. Salary Packaging Agreement & Application Form. Version Date: 12-Sep-2017. Section E - Tax-free Cap Amount. Only the following employers can salary package the tax-free cap. Please select which employer you work for: Queensland Ambulance Service. Legal Aid Queensland Option 1 - I would like to package the entire tax-free

Income declaration form - for financial years up to and including 2008-2009; Use the form that relates to the financial year you are declaring your income for. We use your adjusted taxable income to calculate your child support assessment. Hello Does any one have a format for Income Tax Investment Declaration format for 2017-18? Also would like to understand if any rules have changed wrt. the declaration of House rent under Rs.1lac/ annum in terms of PAN no of landlord / agreement etc.

Income declaration form - for financial years up to and including 2008-2009; Use the form that relates to the financial year you are declaring your income for. We use your adjusted taxable income to calculate your child support assessment. Instructions and form for taxpayers Tax file number declaration Information you provide in this declaration will allow your payer to work out how much tax to withhold from payments made to you. This is not a TFN application form. To apply for a TFN, go to ato.gov.au/tfn Terms we use When we say: payer, we mean the business or individual

Fillable and printable Statutory Declaration Form 2020. Fill, sign and download Statutory Declaration Form online on Handypdf.com Passport Declaration Form Nexus Declaration Form Medical Declaration Form Investment Declaration Form Income Tax Declaration Form Income Declaration Form Identity Declaration Form Health Declaration Form Gift Aid Employment agent exemption from payroll tax. have your client complete a declaration by exempt client form (Form P9) keep this declaration for 5 years - we may ask for this in the future (you do not need to send this to us unless we request it). Note: Employment agency contracts whose purpose or effect is to reduce or avoid payroll tax may

Jul 07, 2017 · Tax File Number Declaration forms are now electronic. Employers no longer need to order paper TFN forms thereby eliminating waste and inefficiencies SBR product list by form. SBR product list by form Skip to main content Skip to main navigation. Standard Business Reporting Electronic Payment System Transaction 2017; ELSTagFormat; EmployerTICK (ETIC) Family trust election, revocation or variation (2787) Tax file number declaration (3092) Tax Practitioner Client Management Reports

Jul 01, 2019 · You may be assessed for land tax as an absentee because you live or work overseas, but your status may change if you become an Australian citizen or permanent visa holder. Complete an absentee/resident status declaration (Form LT16) if you return to live permanently in Australia after you have lived overseas. These guidelines have been developed to help producers complete an application for an Individually Droughted Property (IDP) declaration. An IDP allows access to Queensland Government drought assistance prior to an area drought declaration. What assistance …

Employment agent exemption from payroll tax. have your client complete a declaration by exempt client form (Form P9) keep this declaration for 5 years - we may ask for this in the future (you do not need to send this to us unless we request it). Note: Employment agency contracts whose purpose or effect is to reduce or avoid payroll tax may 2017 PERSONAL PROPERTY DECLARATION – SHORT FORM Commercial and financial information is not open to public inspection. TAXABLE PROPERTY INFORMATION Give actual acquisition costs including any additional charges for transportation and installation by year for each type of property described.

Declaration Form. Statutory Declaration Form. Statutory Declaration - Queensland. Statutory Declaration - Queensland. 1. Oaths A ct 1867 . Statuto ry D ecl aration. QUEEN SL AND . TO W I T. I, of in t he Sta t e of Q ue e n s l a nd . do sol em nl y a nd si ncer el y declar e that. And I m ake this solem n dec laration c o nsc ientious l y be The Right to Information Act 2009 (the Act) commenced on 1 July 2009. Documents released under the Act to applicants will be progressively published via our disclosure log.

Hello Does any one have a format for Income Tax Investment Declaration format for 2017-18? Also would like to understand if any rules have changed wrt. the declaration of House rent under Rs.1lac/ annum in terms of PAN no of landlord / agreement etc. The Right to Information Act 2009 (the Act) commenced on 1 July 2009. Documents released under the Act to applicants will be progressively published via our disclosure log.

SBR product list by form. SBR product list by form Skip to main content Skip to main navigation. Standard Business Reporting Electronic Payment System Transaction 2017; ELSTagFormat; EmployerTICK (ETIC) Family trust election, revocation or variation (2787) Tax file number declaration (3092) Tax Practitioner Client Management Reports BOQ Money Market Deposit Accounts Managed by DDH Graham Limited Declaration of Overseas Tax Status Please complete form in BLACK INK using CAPITAL letters. 1 ACCOUNT NUMBER 2 ACCOUNT NAME (IN FULL) 3 TAX JURISDICTION - SELF CERTIFICATION Please tick the relevant entity type (use additional forms where insufficient space available)